It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

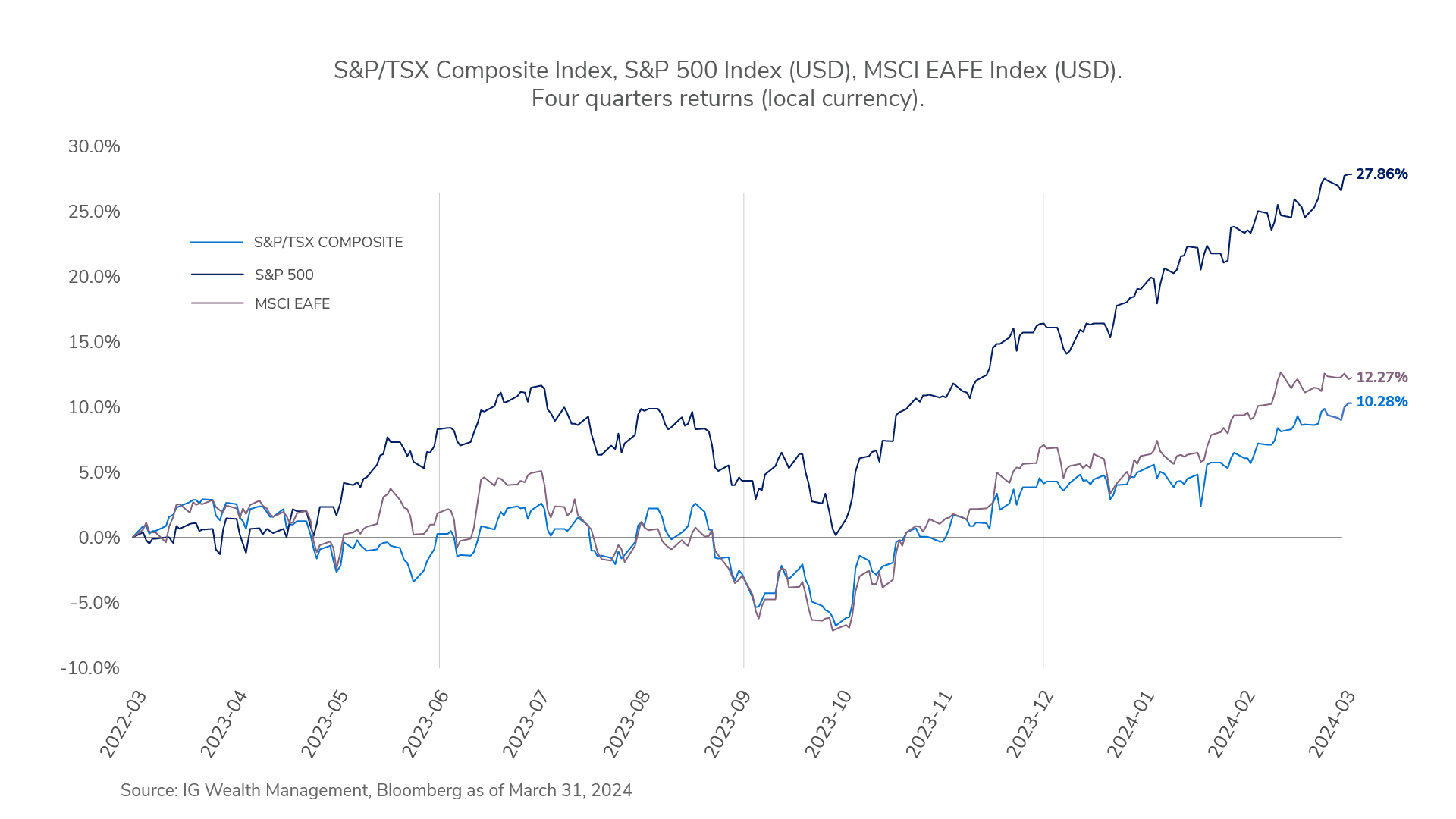

In Canada, the S&P/TSX Composite Index was up 6.6% during the quarter, led by health care (18.4%) and energy (13.1%), while communication services (-8.5%) and utilities (-1.1%) detracted. In the U.S., the S&P 500 Index returned 10.6% in local currency terms (13.5% in Canadian dollars), led by information technology (14.4%) and consumer discretionary (11.1%), while utilities (-5.0%) and consumer staples (-3.2%) detracted. In developed markets, the MSCI EAFE Index returned 10.1% in local currency terms (8.7% in Canadian dollar terms) with Japan (19.3%) and Italy (16.5%) leading performance, while Hong Kong (-11.5%) was among the weakest performers. Global fixed income markets were down as bond yields climbed across the board. The ICE BofA Global Broad Market Bond Index (hedged to Canadian dollar) was down 0.4%. Canadian bonds were also down as the FTSE Canada Universe Bond Index returned -0.9%. High-yield bonds were up, with the ICE BofA U.S. High Yield Bond Index (hedged to Canadian dollar) returning 1.4%.

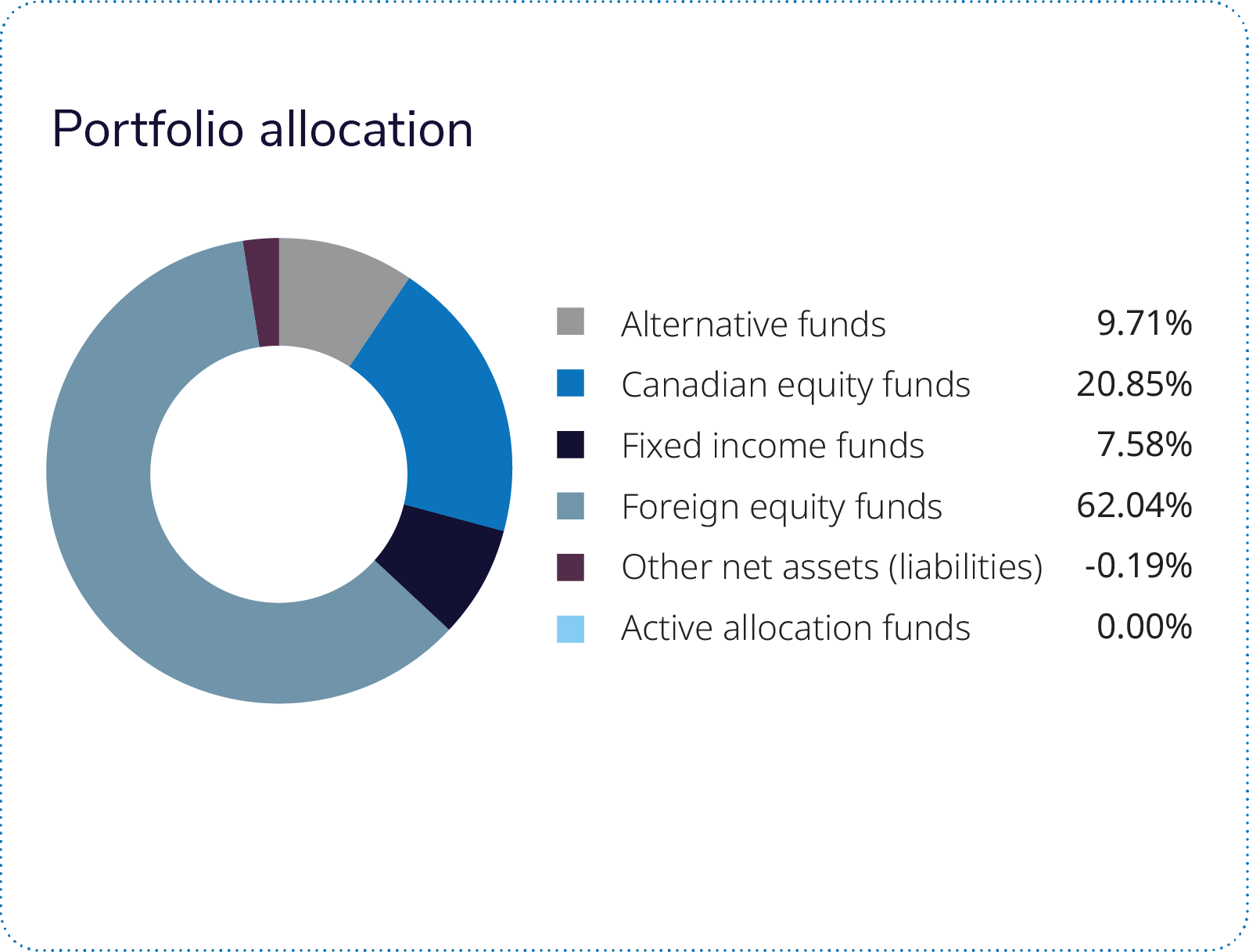

Mackenzie – IG U.S. Equity Pool, the Mackenzie – IG Canadian Equity Pool, and the Mackenzie EAFE Equity Pool were the largest contributors. Mackenzie – IG U.S. Equity Pool posted a positive return, but underperformed its benchmark, with security selection in the financials sector as the leading detractor. Mackenzie – IG Canadian Equity Pool posted a positive return but slightly underperformed its benchmark, with security selection in the materials sector as the leading detractor. Mackenzie EAFE Equity Pool posted a positive return but underperformed its benchmark, with security selection in the financials sector as the leading detractor.

Mackenzie Enhanced Fixed Income Risk Premia Fund was the sole detractor in the portfolio. Mackenzie Enhanced Fixed Income Risk Premia Fund is a levered fixed income fund. The investment team uses leverage to manage total portfolio fixed income exposure in a capital efficient way. Rising bond yields over the period resulted in a decline in the fund’s returns.

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.