About your client statement

When markets are turbulent, keeping a long-term focus on your financial goals is more important than ever. Your IG Living Plan™ has been designed to help you weather all market conditions, positioning you in the best possible way to achieve your long-term financial goals.

Your financial well-being, peace of mind and progress towards your goals are always top of mind.

Statement inserts

-

2025

- Know Your Client (KYC) - Information Update - December 2025

- iProfile Insert - December 2025

- Know Your Client (KYC) - Information Update - September 2025

- Important update - IG Wealth Connect - September 2025

- Important update - IG Wealth Management - September 2025

- iProfile Insert - June 2025

- Important information - IG Wealth Connect - June 2025

- Important information - IG Wealth Management - June 2025

- Know Your Client (KYC) - Information Update - June 2025

- Know Your Client (KYC) - Information Update - March 2025

-

2024

- Notice to Quebec Life Income Funds (LIF) holders

- IGFS Nominee – iProfile Insert - December 2024

- Know Your Client (KYC) - Information Update - June 2024

- IGFS Nominee – iProfile Insert - June 2024

- IGFS Nominee – Information Update - May 2024

- IGFS – Information Update - May 2024

- IGSI – Information Update - May 2024

Portfolio Overview

-

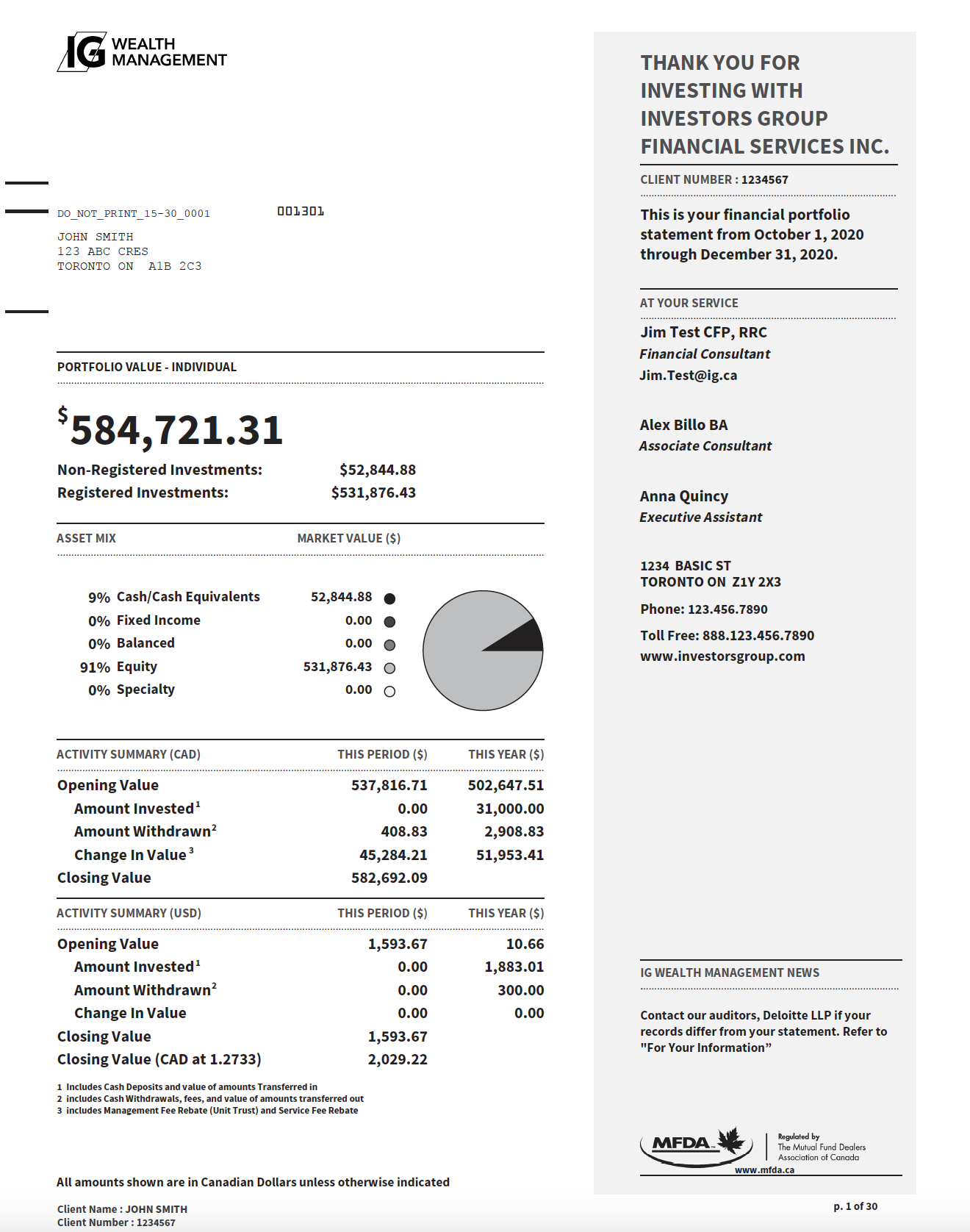

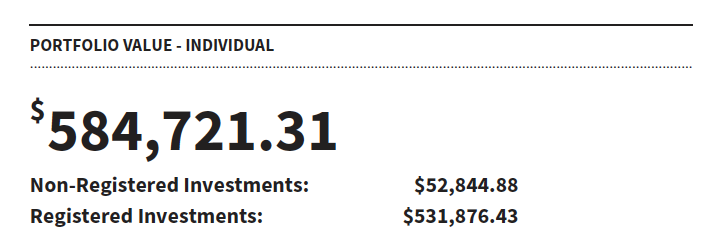

Portfolio Value

The market value of the registered and non-registered investments reported in this statement at the end of the reporting period. If you have US dollar investments, the Canadian dollar equivalent as of the statement closing date will be included in this total.

-

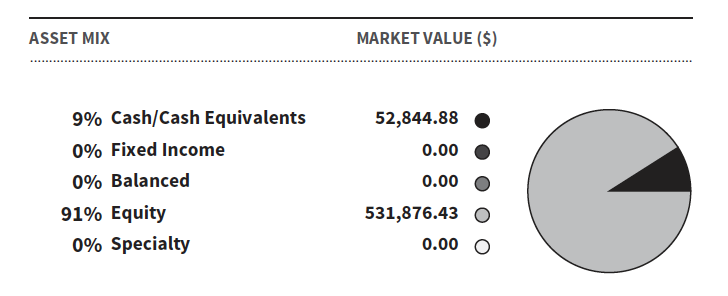

Asset Mix

Shows how your portfolio is allocated among five asset classes: Cash/Cash Equivalents, Fixed Income, Balanced, Equity and Specialty. Your asset mix may change each period as a result of account activity and market fluctuations.

-

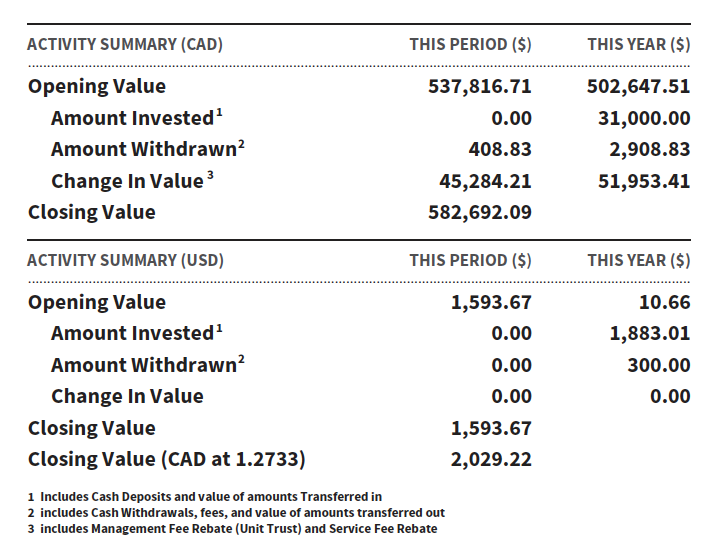

Activity Summary

Shows the total amounts that have been invested or redeemed from your portfolio for the period and for the year.Change in Value shows the impact of market fluctuations on your investments.

-

Dealer Firm

Either Investors Group Securities Inc. or Investors Group Financial Services will appear here, depending on whether your IG Wealth Management Consultant is licensed with the Investment Industry Regulatory Organization of Canada (IIROC), or the Mutual Fund Dealers' Association (MFDA).

-

Reporting Period

The current values reported on your statement are at the final date of the reporting period.

-

At Your Service

Here is where to call if you have any questions or concerns.

-

IG Wealth Management News

Look here for timely news to help you manage your day-to-day finances.

Account summary

Each account type in your portfolio is reported separately.

Account types may include:

- Investment (non-registered stocks, bonds mutual funds, etc.)

- U.S. dollar

- Registered accounts (RSPs, TFSAs, RRIFs, RESPs, etc.)

-

Market Value

The current value of your investments at the close of the reporting period for that particular account.

-

Book Cost

The total amount paid to purchase an investment, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations.

-

Summary

Total inflows and outflows from the account during the year. Depending on the account type, it may include contributions, withdrawals, income, grants, as well as minimum and maximum withdrawal amounts.

-

Account Authorization and Ownership

Individuals named as stakeholders in your account appear in this area. It may include beneficiaries, powers of attorney, and individuals with signing authority or trading authority, depending on the type of account.

Be sure to review and update this information as required.

-

Asset Mix

Details: Shows how investments held within the account are allocated between: Cash/Cash Equivalents, Fixed Income, Balanced, Equity and Specialty classes.

(Note: The asset classes are different for investments held in IG Wealth Management iProfile and Azure.)

-

RESP Grant Information New

The RESP chart will be updated to show contributions and grants broken down by beneficiary and also by grant type. The chart will not include transfer-in values.

-

RESP Transactions New

The RESP statement transaction descriptions reflect the specific grant incentive transaction.

Holding details

A summary of the investments held within the account, their book cost and market value.

-

Symbol/Code

A code used to identify the particular investment for transaction purposes.

-

How Held

May be displayed as segregated, non-trading, or free, depending on the status of the purchase transaction for the investment. Investments are held as 'segregated' after the purchase transaction is complete.

-

Book Cost

The total amount paid to purchase the investment.

-

Quantity

The number of units or shares held at the end of the reporting period.

-

Price

The market price of the holding at the end of the reporting period.

-

Market Value

Current value of the investment at the end of the reporting period.

-

Percent of holdings

The percentage that each individual holding represents for that particular account.

-

Notes

If your holdings include investments that may be subject to a deferred sales charge (DSC) upon redemption, they will be identified by a "¤".

Transaction detail

For each type of account in your portfolio, transaction details of individual holdings are reported for the period.

-

Cash Transactions

When money enters or leaves your account, or moves around within your account, it passes through as a cash transaction. Money that is not invested may also be held as a cash balance.

-

Investment Transactions

For each account, details of each transaction are listed, such as when you buy and sell investments or reinvest earnings as well as the quantity, price and dollar amount.

-

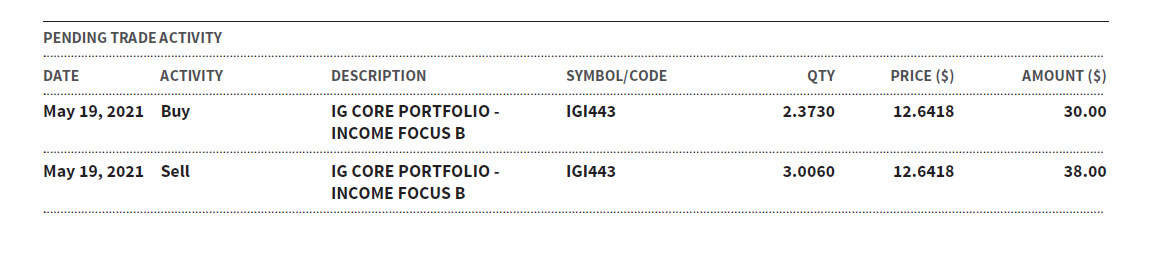

Pending Trades New

Equity, fixed income and mutual fund transactions processed prior to the end of the statement end date.

Your Performance Summary

-

Period Dates

Your rate of return will be calculated for the year-to-date, as well as the last 1, 3 and 5 years, if you were invested at the starting date for each period.

-

Rate of Return

What you need to know.

- Uses an annualized dollar-weighted formula, standard for the Canadian investment industry.

- Takes into consideration any amounts that are withdrawn or contributed to your plans/accounts, and when they occur.

- It may be different than the fund or investment's rate of return.

- There are rare occasions where we are unable to calculate the rate of return. Should this occur, please contact your IG Wealth Management Consultant for assistance.

-

Statement Since

For Canadian dollar accounts open prior to January 1, 2009, the rate of return will be calculated starting at January 1, 2009. The rate of return on Canadian dollar accounts opened after January 1, 2009 will be calculated starting from their inception date.

The rate of return for US dollar accounts will be calculated starting at November 7, 2016, or the inception date, whichever is later.

-

Opening Value Date New

The date when the account was opened.

- For accounts opened prior to January 1, 2009, the opening value date is January 1, 2009.

- For accounts opened at B2B Bank, the opening value date is set at November 7, 2016.

-

Opening Value New

The value of cash and securities on the opening value date.

- For accounts opened prior to January 1, 2009, the opening value is the market value of cash and securities as of January 1, 2009.

- For accounts opened at B2B Bank, the opening value is the value of cash and securities moved from the B2B bank as of November 7, 2016.

-

Amount Invested New

Includes new cash contributions and securities transferred in-kind.

-

Amount Withdrawn New

Includes cash withdrawals and securities transferred out in-kind.

-

Net Invested New

The total value of the cash and securities invested minus cash withdrawals and securities transferred out, and any applicable fees.

-

Change in Value New

Represents the closing value minus the opening value plus net investments.

-

Closing Value New

Represents the value of the cash and securities as of the end of the performance reporting period.

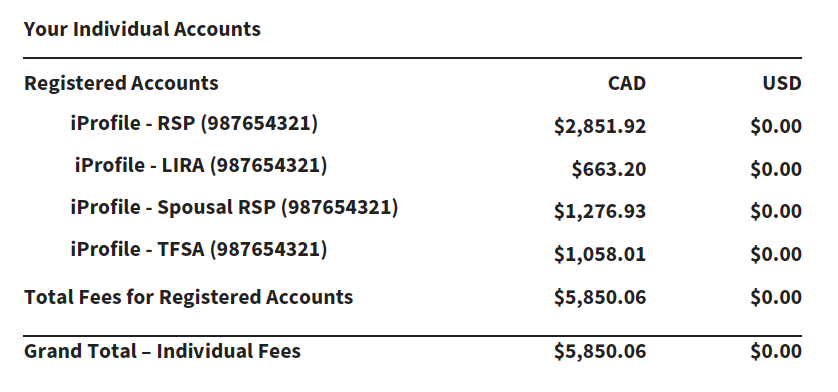

Fee Summary

Your Fee Summary provides a breakdown of the money received by IG Wealth Management to provide services to you over a 12 month period. It is included with the statement issued to you for the period ending on June 30.

There are other fees and charges which may apply to your account that are not shown on this report. They include (but are not limited to):

- Fees associated with buying or selling Guaranteed Investment Certificates (GICs) or Term Certain Annuities (TCAs).

- Fees which may be paid by funds that you are invested in.

- Certain other fees that are reported and mailed separately, (i.e. short-term transfer fees, short-term trading fees, and liquidity fees.)

See "About Fees" for more detailed information on the fees which may be applicable to your account.

-

Time Period

The Fee Summary is for the 12 months ending on June 30 and provided with your statement for the period ending June 30.

-

Direct Fees

Administration fees and transaction fees are paid directly by you. Administration fees are for general administration of your account. Transaction fees are charged for specific transactions that you initiate.

-

Taxes

Taxes may apply to some direct fees and will be added to the total amount of fees paid.

-

Indirect Fees

These are payments IG Wealth Management receives from the funds you own.

-

Trailing Commissions

If you own mutual funds that are NOT IG Wealth Management funds, trailing commissions are paid by those funds to IG Wealth Management for services and advice we provide to you.

-

Dealer fee

If you own IG Wealth Management mutual funds, a dealer fee is paid by those funds to IG Wealth Management for services and advice we provide to you.

-

Total Fees

Represents the total amount of direct and indirect fees that are paid to IG Wealth Management for servicing your account in the past 12 months.

For your information

-

For Your Information

At the close of your statement is important information for you to know as an IG Wealth Management client.

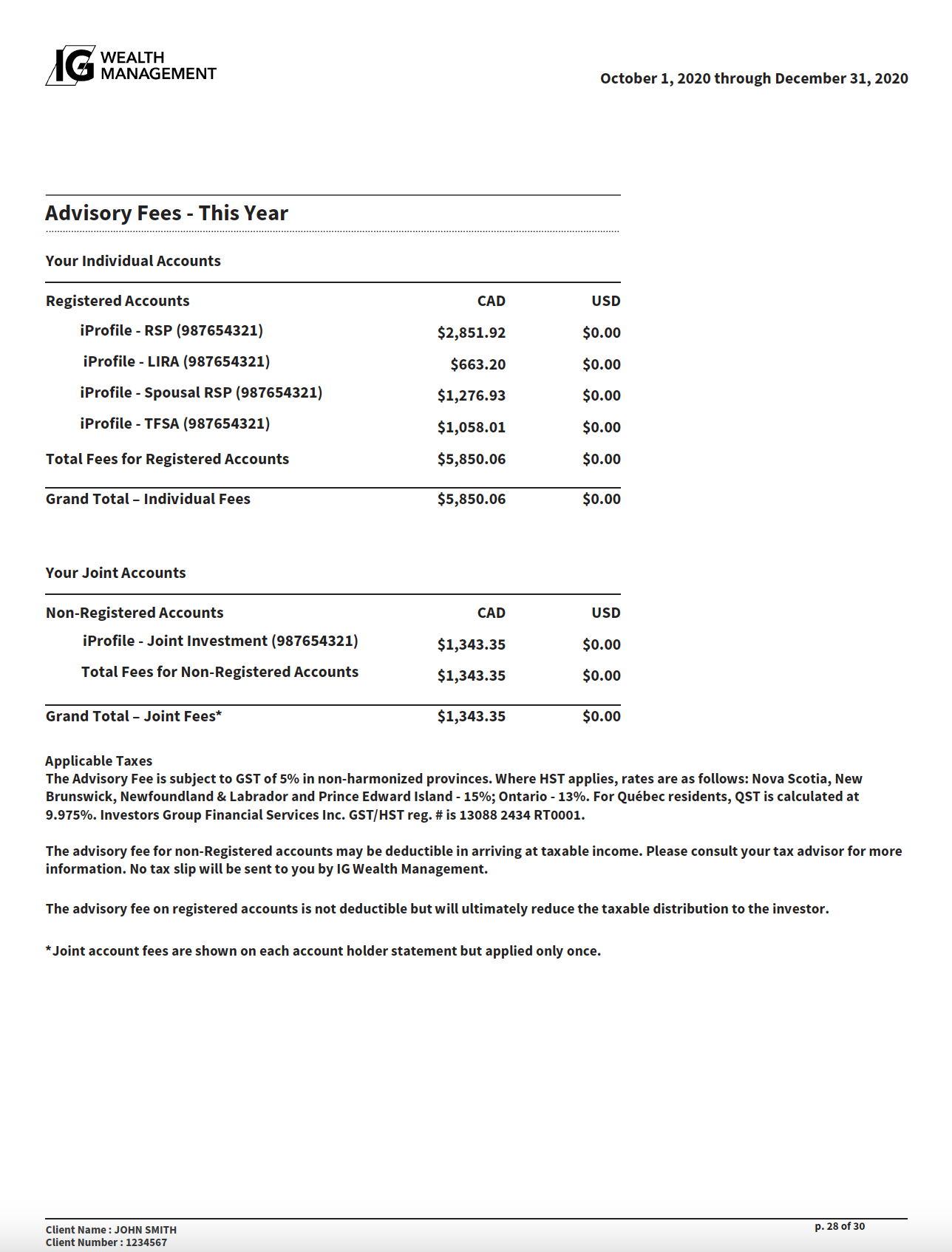

Advisory Fees – This Year

-

Advisory Fee - This Year

This section will appear in your statement each time there is an advisory fee charge to your account.

-

Your Individual Accounts

This section lists all advisory fees charged to your Individual accounts.

-

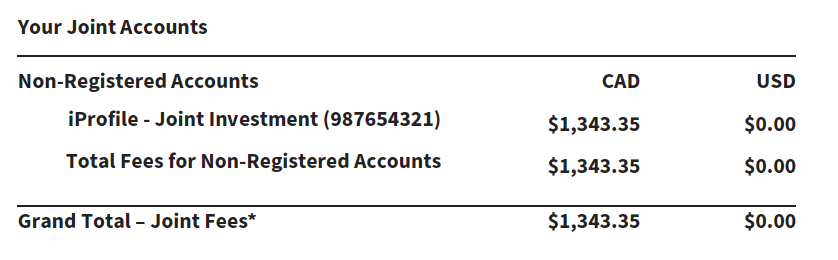

Your Joint Accounts

This section lists all advisory fees charged to your joint accounts. As per the attached disclaimer, these fees are only charged once, but will be shown on both your statement and the statement of the person with whom you share the account.

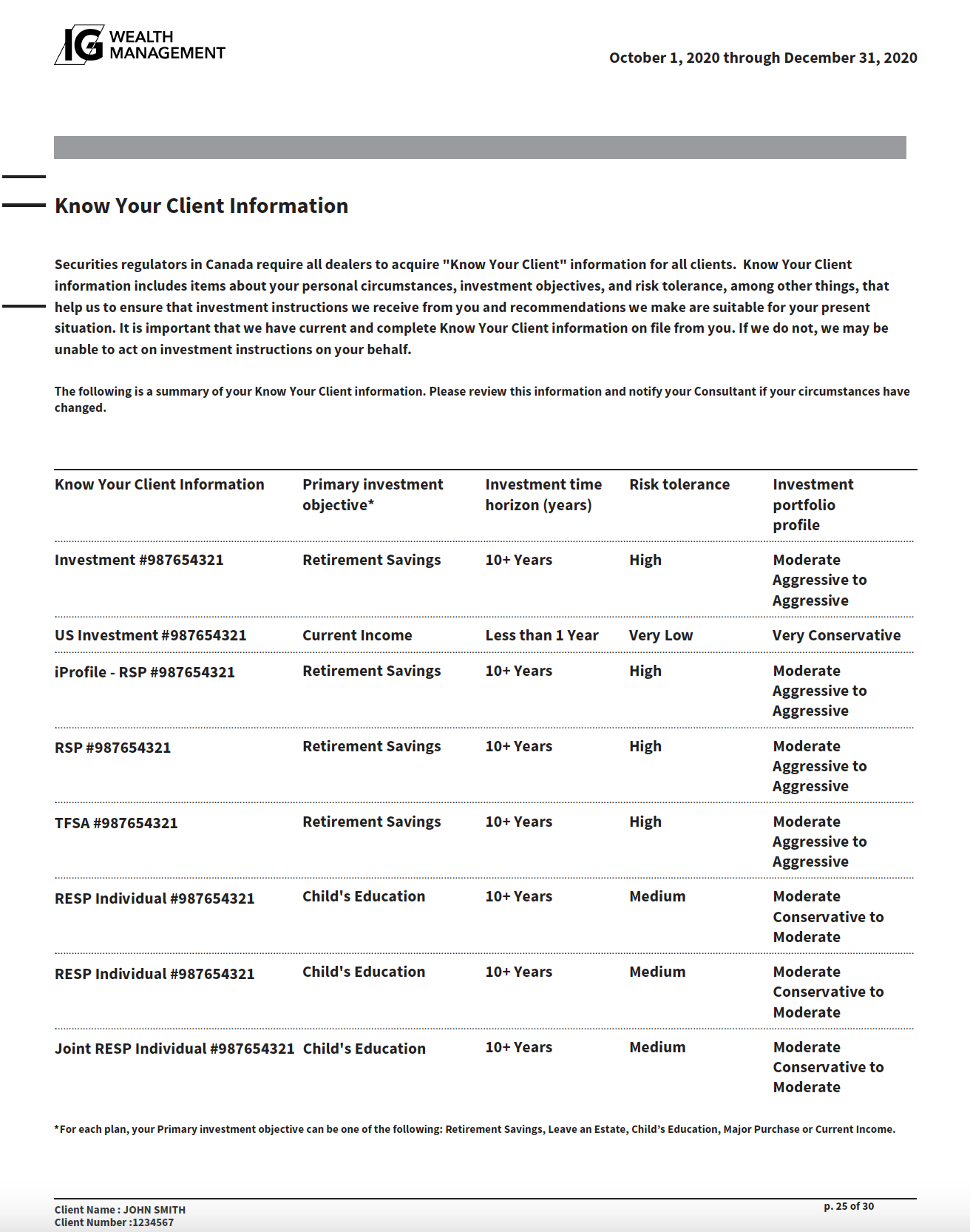

Know your Client Information

-

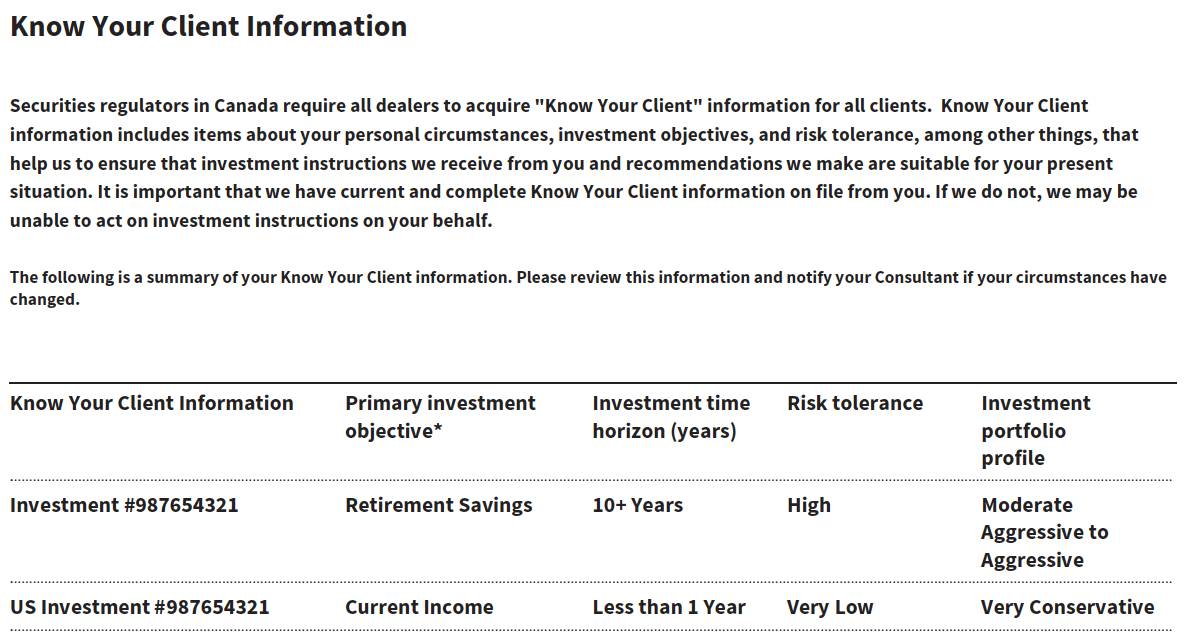

Know your Client Information

The final statement for each calendar year contains "Know Your Client" information we have on record that summarizes the type of investor you are. For example, your time horizon, risk tolerance and level of knowledge about investing. Please advise your Consultant if this information is missing or appears incorrect.

Securities Information Mailings

-

Securities Information Mailings

This section shows that security holder material you have opted to receive for each of your accounts. Contact us to change your preferences.

Have Questions?

Contact your IG Advisor who is always ready to help. You may also contact us regarding your statement.