Portfolio returns: Q1 2024

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 12, 2013) |

IG Managed Payout Portfolio with Enhanced Growth F |

1.33 |

2.79 |

2.79 |

7.07 |

3.86 |

4.32 |

4.43 |

5.05 |

Quartile rankings |

4 |

4 |

4 |

4 |

2 |

3 |

3 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 12, 2013) |

IG Managed Payout Portfolio with Enhanced Growth F |

1.33 |

2.79 |

2.79 |

7.07 |

3.86 |

4.32 |

4.43 |

5.05 |

Quartile rankings |

4 |

4 |

4 |

4 |

2 |

3 |

3 |

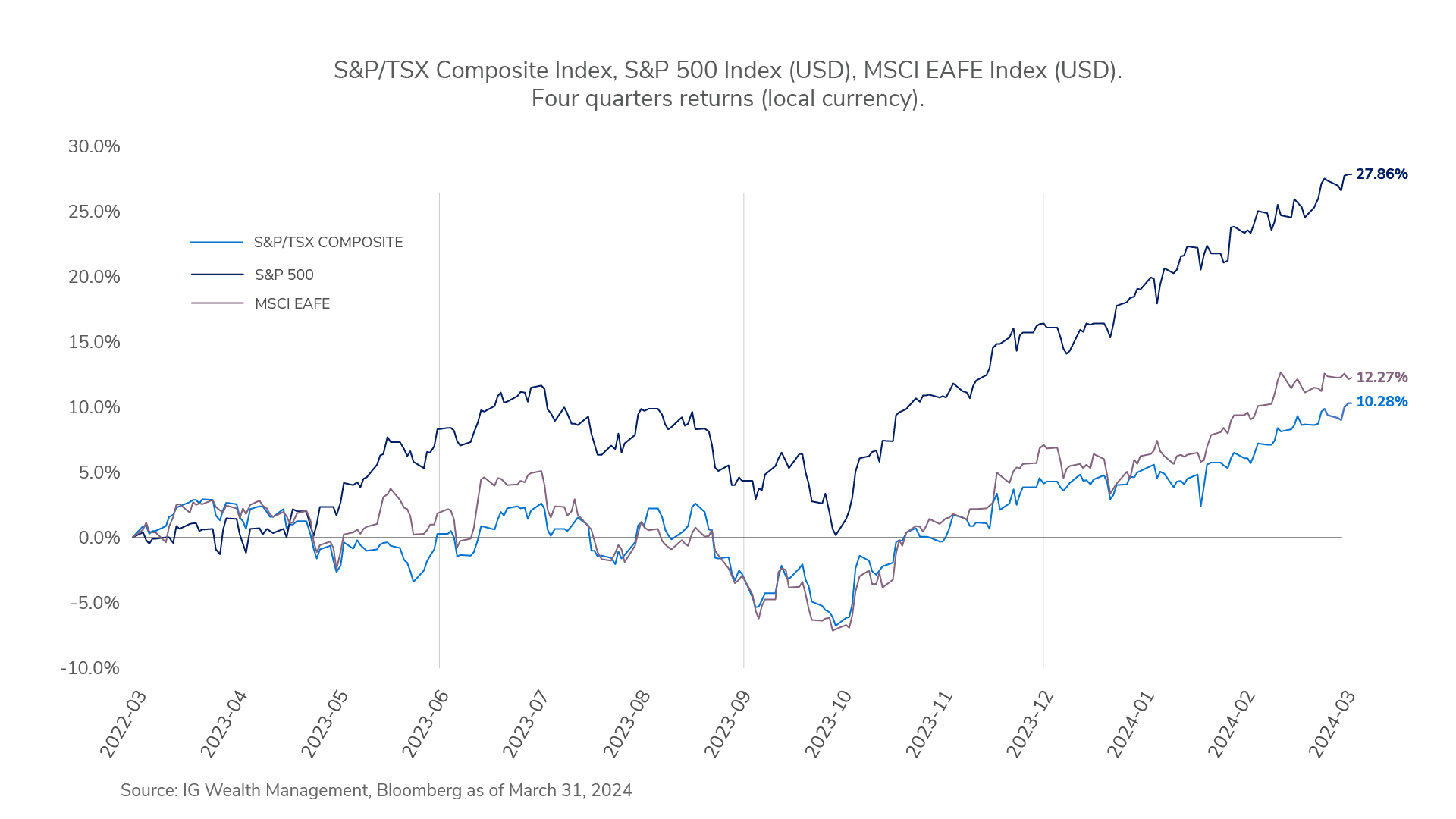

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

IG Managed Payout Portfolio was up in the quarter. Within equities, the Mackenzie Global Equity Income Fund was the largest weighted allocation in the portfolio and the largest contributor to performance. Relative to its benchmark, the fund underperformed. The options strategy, designed to reduce drawdowns when equity markets are stressed, detracted from performance as equity markets rallied. Security selection in the financials and materials sectors also detracted from relative performance. The portfolio’s position in gold contributed positively to performance.

Within fixed income, the Mackenzie Unconstrained Fixed Income Fund contributed positively to performance. It was the largest weighted fixed income allocation in the portfolio. It posted positive returns in the quarter and outperformed its benchmark. Security selection in corporate bonds and duration management in government bonds contributed the most to relative performance. On the contrary, duration management in corporate bonds detracted.

Mackenzie Canadian Bond Fund was the second-largest fixed income allocation in the portfolio and the largest detractor from portfolio returns. Relative to its benchmark, the fund outperformed slightly. Duration management in government bonds detracted the most from performance. Mackenzie Sovereign Bond Fund also detracted. It underperformed its benchmark primarily due to currency exchange.

In the first quarter, equity markets delivered a solid performance, reinforcing the sentiment that inflation is nearly under control and recession fears for the U.S. economy are subsiding.

The U.S. maintained a positive economic outlook, whereas Canada has experienced several months of subdued GDP growth, highlighting divergent economic narratives between the two closely linked markets. This contrast may lead the Bank of Canada to enact policy changes before the U.S. Federal Reserve, to address Canada's specific economic hurdles.

The team believes that Q1 GDP growth in the U.S. will continue the up trend from 2023 and reduce the Federal Reserve’s urgency in initiating rate cuts. The team does not see inflation stabilizing at 2% over the next few months given the uptick in various inflation measures and continued strength of the U.S. economy. The team thinks the Federal Reserve will err towards keeping rates tighter than what classic monetary policy would suggest.

The situation in Canada appears more dire than in the U.S. With both headline and core inflation rates in Canada collapsing below 2% on a three-month annualized basis, the team believes that the Bank of Canada will be ready for cuts soon and will do so at a steady pace and get back to neutral in 2025. The team believes that population growth and government deficits will keep pressure on long-term yields, but the yield curve will steepen.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Consultant before investing. The rate of return is the historical annual compounded total return as of March 31, 2024, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). Any additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

© Investors Group Inc. 2024