Portfolio returns: Q1 2024

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Managed Risk Portfolio – Balanced F |

2.56 |

6.87 |

6.87 |

12.44 |

6.38 |

6.66 |

6.17 |

|

Quartile rankings |

2 |

2 |

2 |

3 |

1 |

2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Managed Risk Portfolio – Balanced F |

2.56 |

6.87 |

6.87 |

12.44 |

6.38 |

6.66 |

6.17 |

|

Quartile rankings |

2 |

2 |

2 |

3 |

1 |

2 |

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

It was a positive quarter for equity investors, helped by resilient economic data in the U.S. coming in stronger than initially expected, benefiting global equities overall. However, it was a more challenging period for fixed income investors, with sticky inflation and strong economic growth shifting expectations for interest rate cuts by the Federal Reserve down to three instead of the six forecasted at the start of the year, putting pressure on bond prices as yields climbed.

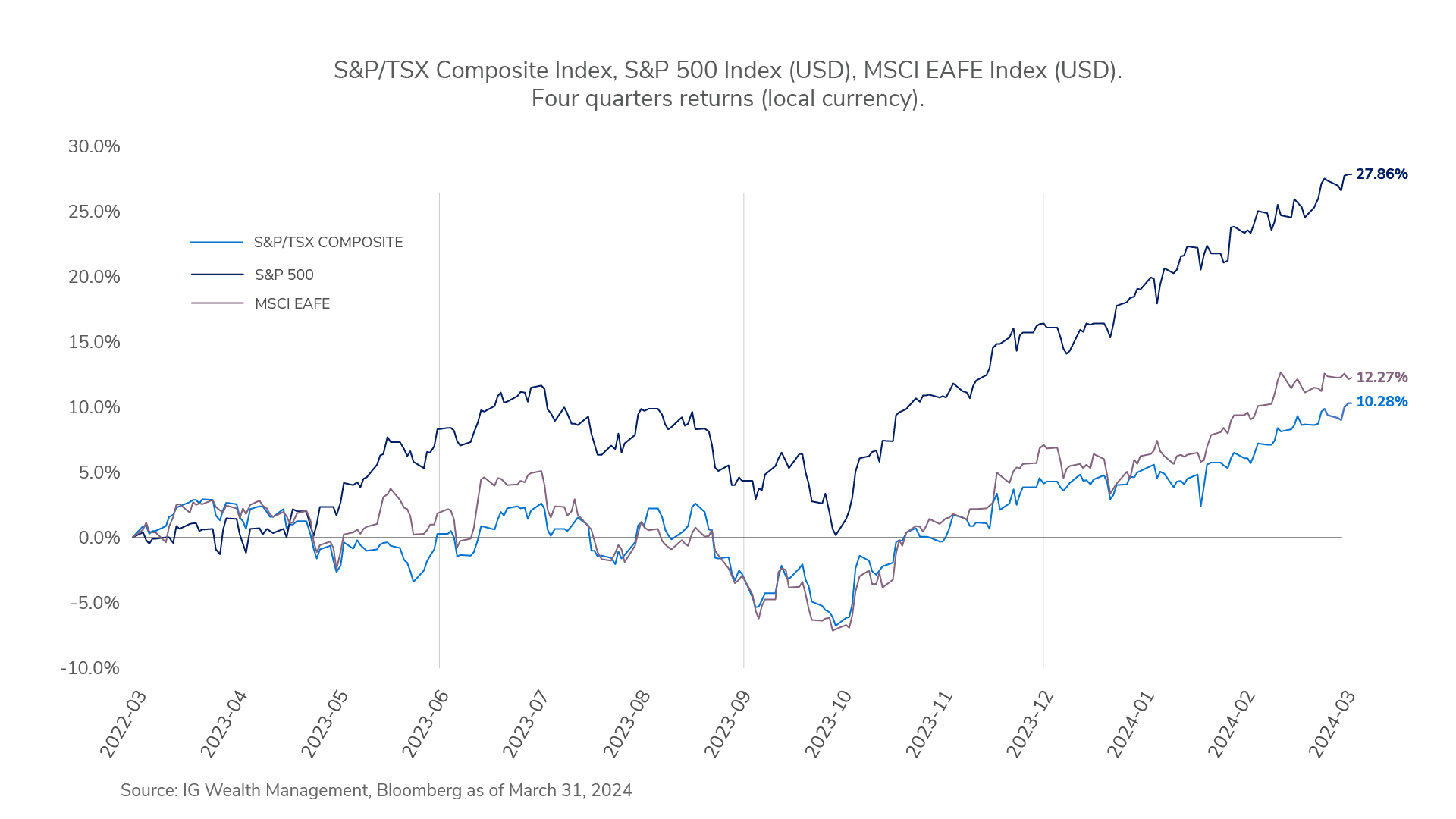

In Canada, the S&P/TSX Composite Index was up 6.6% during the quarter, led by health care (18.4%) and energy (13.1%), while communication services (-8.5%) and utilities (-1.1%) detracted. In the U.S., the S&P 500 Index returned 10.6% in local currency terms (13.5% in Canadian dollars), led by information technology (14.4%) and consumer discretionary (11.1%), while utilities (-5.0%) and consumer staples (-3.2%) detracted. In developed markets, the MSCI EAFE Index returned 10.1% in local currency terms (8.7% in Canadian dollar terms) with Japan (19.3%) and Italy (16.5%) leading performance, while Hong Kong (-11.5%) was among the weakest performers. Global fixed income markets were down as bond yields climbed across the board. The ICE BofA Global Broad Market Bond Index (hedged to Canadian dollar) was down 0.4%. Canadian bonds were also down as the FTSE Canada Universe Bond Index returned -0.9%. High yield bonds were up, with the ICE BofA U.S. High Yield Bond Index (hedged to Canadian dollar) returning 1.4%.

Mackenzie – IG Low Volatility Canadian Equity Pool, the Mackenzie – IG Equity Pool, and the SPDR S&P 500 ETF were the largest contributors. Mackenzie – IG Low Volatility Canadian Equity Pool posted a positive return and outperformed its benchmark, with security selection in the information technology and industrials sectors as the largest contributors. Mackenzie – IG Equity Pool posted a positive return and outperformed its benchmark, with underweight allocations to the consumer staples and utilities sectors as the leading contributors.

Mackenzie – IG Canadian Bond Pool and the iShares 20+ Year Treasury Bond ETF were the largest detractors. Mackenzie – IG Canadian Bond Pool posted a negative return but outperformed its benchmark, benefiting from its overweight allocation to corporate bonds and lower duration positioning. The iShares 20+ Year Treasury Bond ETF posted a negative return as yields appreciated and bond prices declined.

In the first quarter, equity markets delivered a solid performance, reinforcing the sentiment that inflation is nearly under control and recession fears for the U.S. economy are subsiding.

The U.S. maintained a positive economic outlook, whereas Canada has experienced several months of subdued GDP growth, highlighting divergent economic narratives between the two closely linked markets. This contrast may lead the Bank of Canada to enact policy changes before the U.S. Federal Reserve, to address Canada's specific economic hurdles.

While interest rates ticked up in Q1 2024, global stock markets continued to rally, driven by strong momentum and a resilient U.S. economy. U.S. consumer spending remains strong, underpinned by wage gains and a solid labour market, supporting consumer sentiment.

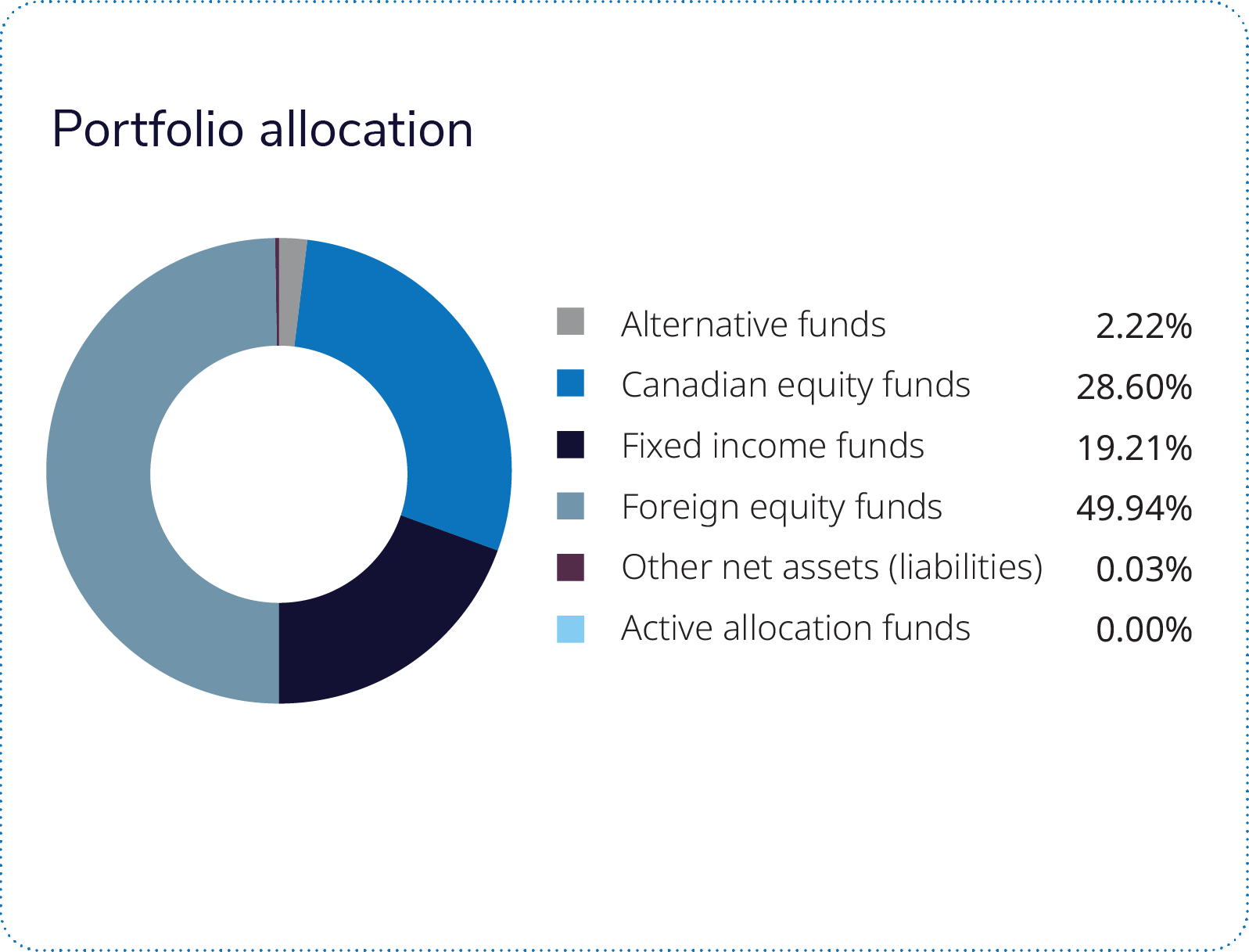

The portfolio continues to favour equities over fixed income, given the constructive economic backdrop, particularly in the U.S. Although Canadian retail sales and jobs are showing some signs of cooling, the forward earnings yield on the S&P/TSX makes a compelling case versus bond yields. While the Portfolio Solutions Team believes there is still more opportunity in equities, we are positioned with a tilt to more defensive areas of the market, including lower volatility equities, limiting downside in an adverse market scenario. In addition, we have a small allocation to gold. The metal posted strong returns in the first quarter, driven by central bank demand, and remains a valuable portfolio diversifier.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Consultant before investing. The rate of return is the historical annual compounded total return as of March 31, 2024, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). Any additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

© Investors Group Inc. 2024