Portfolio returns: Q2 2024

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Managed Risk Portfolio – Income Balanced F |

0.77 |

1.40 |

6.74 |

10.83 |

3.96 |

5.46 |

5.33 |

|

Quartile rankings |

3 |

2 |

2 |

2 |

1 |

2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Managed Risk Portfolio – Income Balanced F |

0.77 |

1.40 |

6.74 |

10.83 |

3.96 |

5.46 |

5.33 |

|

Quartile rankings |

3 |

2 |

2 |

2 |

1 |

2 |

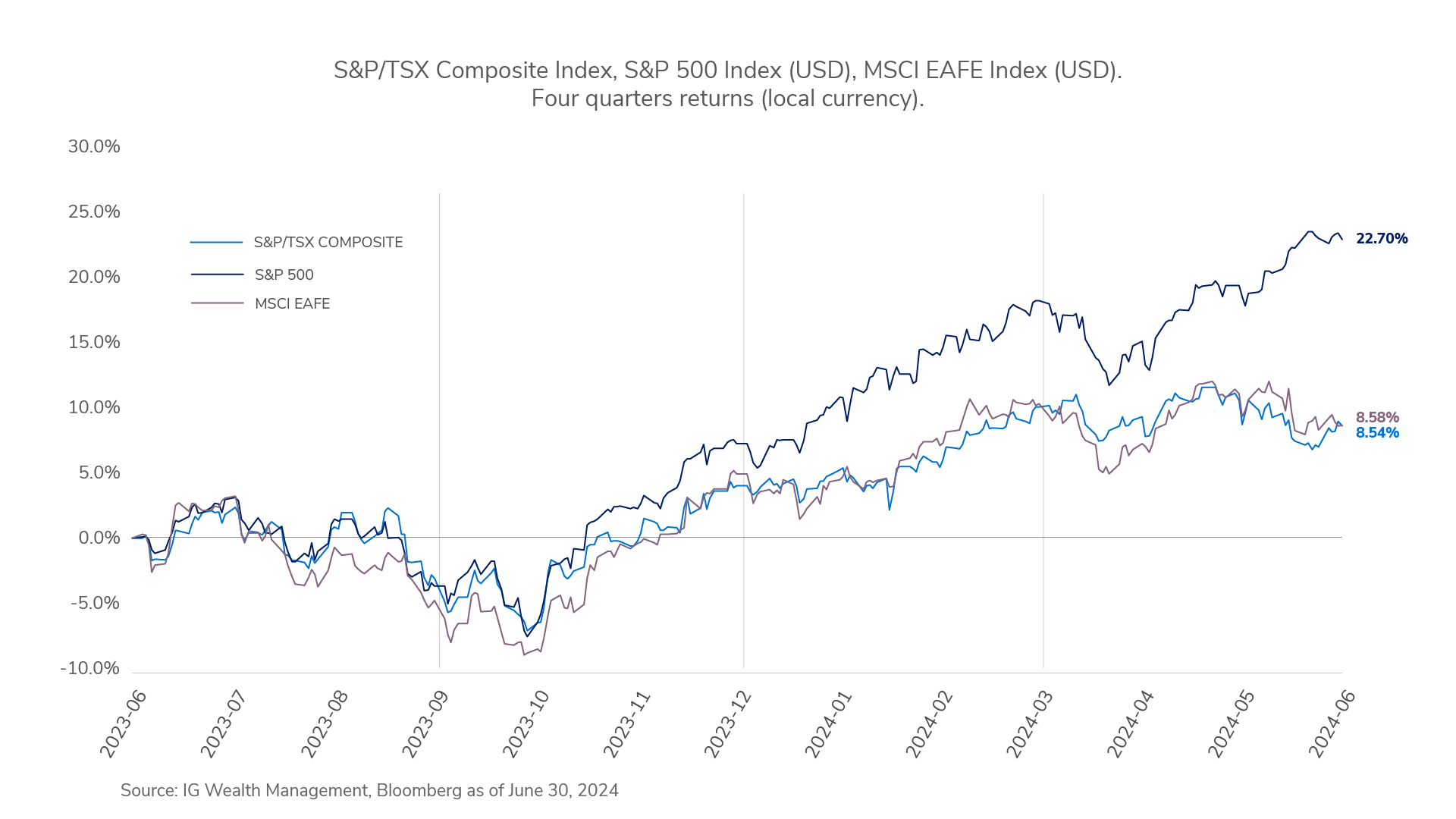

The quarter began on a challenging note for equity and fixed income markets, as hopes for interest rate cuts by the U.S. Federal Reserve dwindled amid persistent inflation concerns, putting pressure on both assets. However, as the quarter drew to a close, there was a notable improvement in sentiment as inflation cooled, increasing investor confidence that the central bank could potentially lower rates as early as September. Despite the U.S. Federal Reserve’s indication of expecting only one rate cut this year, risk assets stabilized and regained lost ground from earlier in the quarter, benefiting from continued economic growth and strong performance in mega-cap information technology companies.

The quarter began on a challenging note for equity and fixed income markets, as hopes for interest rate cuts by the U.S. Federal Reserve dwindled amid persistent inflation concerns, putting pressure on both assets. However, as the quarter drew to a close, there was a notable improvement in sentiment as inflation cooled, increasing investor confidence that the central bank could potentially lower rates as early as September. Despite the U.S. Federal Reserve’s indication of expecting only one rate cut this year, risk assets stabilized and regained lost ground from earlier in the quarter, benefiting from continued economic growth and strong performance in mega-cap information technology companies.

Developed market equities returned 0.9% (MSCI EAFE Index), U.S. equities returned 5.4% (S&P 500 Index), Canadian equities returned -0.5% (S&P/TSX Composite Index), global bonds returned -0.1% (Bloomberg Barclays Global Aggregate Bond Index, CAD-Hedged), Canadian bonds returned 0.9% (FTSE Canada Universe Bond Index) and high-yield bonds returned 0.9% (ICE BofA U.S. High Yield Bond Index, CAD-Hedged).

IG Managed Risk Portfolio – Income Balanced generated a positive return this quarter. The portfolio’s equity allocation was the leading contributor to portfolio returns, followed by fixed income and gold.

Mackenzie U.S. Core Equity Fund, the SPDR Gold Shares ETF, and the IG Mackenzie Global Fund were the largest contributors. The Mackenzie U.S. Core Equity Fund position (+5.8%) outperformed its benchmark with security selection in the information technology and consumer staples sectors as the largest contributors. The SPDR Gold Shares ETF position (+5.6%) appreciated as the price of the precious metal increased over the period. IG – Mackenzie Global Fund (+4.7%) outperformed its benchmark with security selection in the information technology, health care and consumer staples sectors as the largest contributors.

Mackenzie Canadian Dividend Fund and the iShares 20+ Year Treasury Bond ETF were the largest detractors. Mackenzie Canadian Dividend Fund (-1.4%) underperformed its benchmark with security selection in the financials, industrials and materials sectors as the largest detractors. The iShares 20+ Year Treasury Bond ETF position (-1.2%) declined as yields slightly appreciated and bond prices fell.

The second quarter continued to be dominated by the growing influence of artificial intelligence, with investors focused on opportunities in AI-enabled businesses and hardware. Additionally, there was a notable shift in monetary policy as some central banks adjusted their interest-rate policies as inflation risks receded.

In Canada, year-over-year inflation dropped to 2.9%, while in the U.S. it fell to 3.3%. Both indicators are trending downward and remain range bound. The Bank of Canada was the first among central banks in the G7 to cut its overnight lending rate, which we view not as a divergence in monetary policy, but rather as a precursor to the U.S. Federal Reserve eventually following suit. The European Union also cut rates modestly, while the Bank of England held rates as-is, for now. In our view, Canada and Europe have an increased risk of an economic slowdown, while U.S. and emerging market (EM) economic conditions appear to be improving. Canadian and international equities may be weighed down by slower economic growth and potentially weaker earnings growth, with limited valuation upside.

In Q2 2024, global equities, led by the U.S., saw robust gains with the S&P 500 hitting record highs, buoyed by strong earnings from mega-cap technology companies amid relatively stable inflation. While U.S. consumer spending moderated, aligning with labour market trends, consumer health remained strong. In Canada, despite a resilient job market, high interest rates weighed on overall economic performance, prompting a 0.25% rate cut by the Bank of Canada.

We continue to favour equities over fixed income. We expect bond yields to fall over time and offer support for fixed income. However, given the strength of the U.S. consumer and an attractive earnings yield in Canada, we see a compelling case to maintain our allocation to equities. Additionally, we have trimmed our gold position, and took profits on most of our allocation. We believe that with the progress made in containing consumer prices, fixed income will become more attractive.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of June 30, 2024, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). Any additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of June 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

© Investors Group Inc. 2024