GIC's pay interest income, which is the highest taxable form of investment income, compared to dividends and capital gains. It’s fully taxable at an investor’s marginal tax rate.

A less tangible impact to investment income is inflation. It erodes the value of your money over time; a year from now, $1 will not be able to purchase as much as it would today.

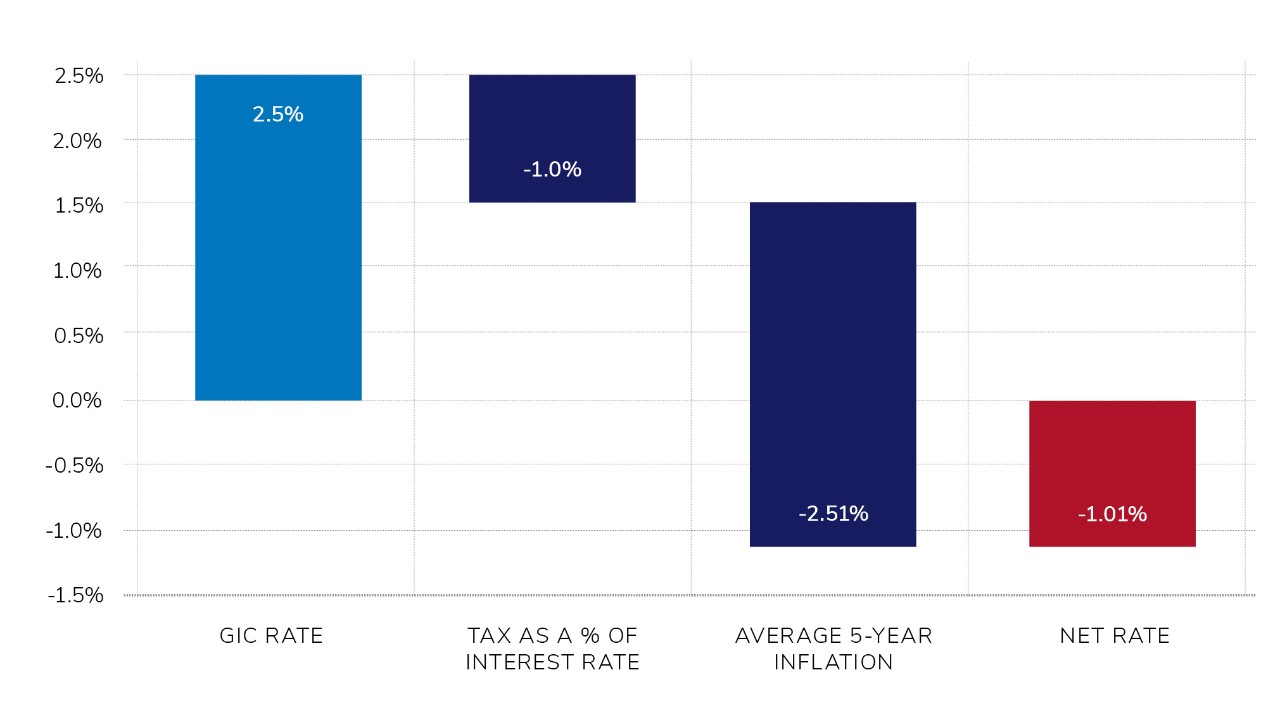

When you deduct taxes and inflation, the net income generated by a GIC can look very different, here is an example:

GIC interest rate: 2.5%

Marginal tax rate: 40%

Inflation rate: 2.51%*