Mackenzie North American Value Equity

Mandate commentary

Q1 2025

Highlights

① Positive returns for the mandate outperformed the benchmark. Stock selection in consumer discretionary and industrials contributed positively. Positive stock selection in Canadian financials and U.S. consumer staples further contributed.

② Tariffs cast shadow over consumer confidence.

③ Bank of Canada and U.S. Federal Reserve monetary policies diverge.

Mandate overview

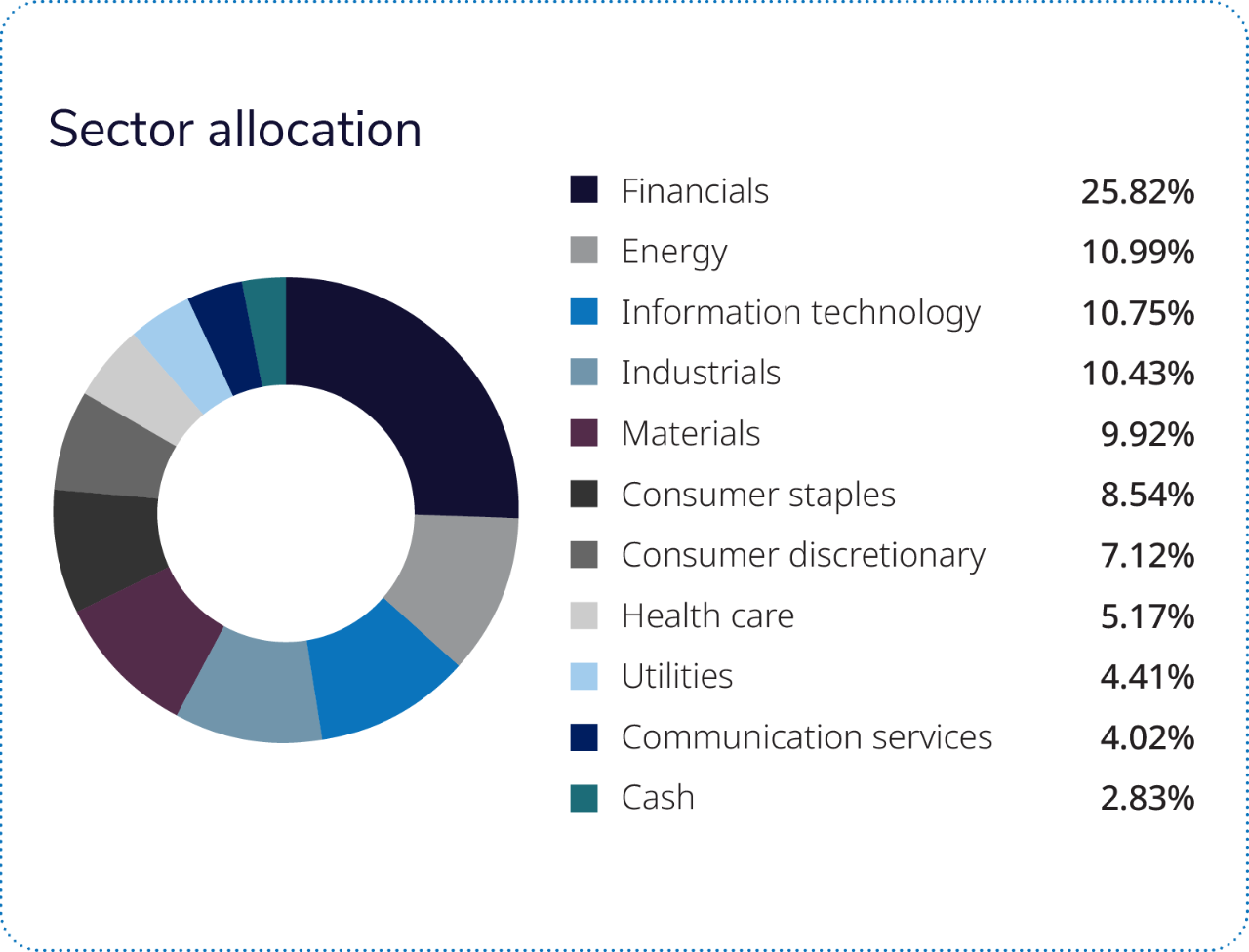

Performance was positive over the period and outperformed the benchmark. The Canadian market outperformed the U.S. market this past quarter (in local currency terms). Positive stock selection in the financials and industrials sectors in Canada contributed positively to returns relative to the benchmark. An underweight exposure to the information technology sector in Canada also contributed positively to returns.

In the U.S., positive stock selection in the consumer discretionary, consumer staples and health care sectors contributed positively to returns relative to the benchmark. This was slightly offset by negative stock selection in the materials sector.

Mandate: Positive returns outperformed the benchmark.

Performance contributors

Positive stock selections in the Canadian financials and industrials sectors had the highest contributions to relative performance.

Positive stock selection in the U.S. consumer discretionary, consumer staples and health care sectors contributed positively to relative performance.

Performance detractors

Negative stock selection in the Canadian materials sector was the only notable detractor from relative performance.

Negative stock selection in the U.S. materials sector also detracted from relative performance.

Total gross returns:

Total return | QTD | YTD | 1YR | 3YR | 5YR | SINCE INC. (NOV. 14, 2016) |

MACKENZIE NORTH AMERICAN VALUE EQUITY | 3.40%

| 3.40%

| 14.54%

| 8.64%

| 17.16%

| 9.38%

|

Mandate repositioning

The mandate modestly added to its existing positions in Alimentation Couche-Tard Inc. and initiated a new position in CRH Plc.

The mandate trimmed its positions in Canadian Pacific Kansas City Ltd. and Toronto Dominion Bank.

Market overview: increased uncertainty in U.S. markets favoured international equities

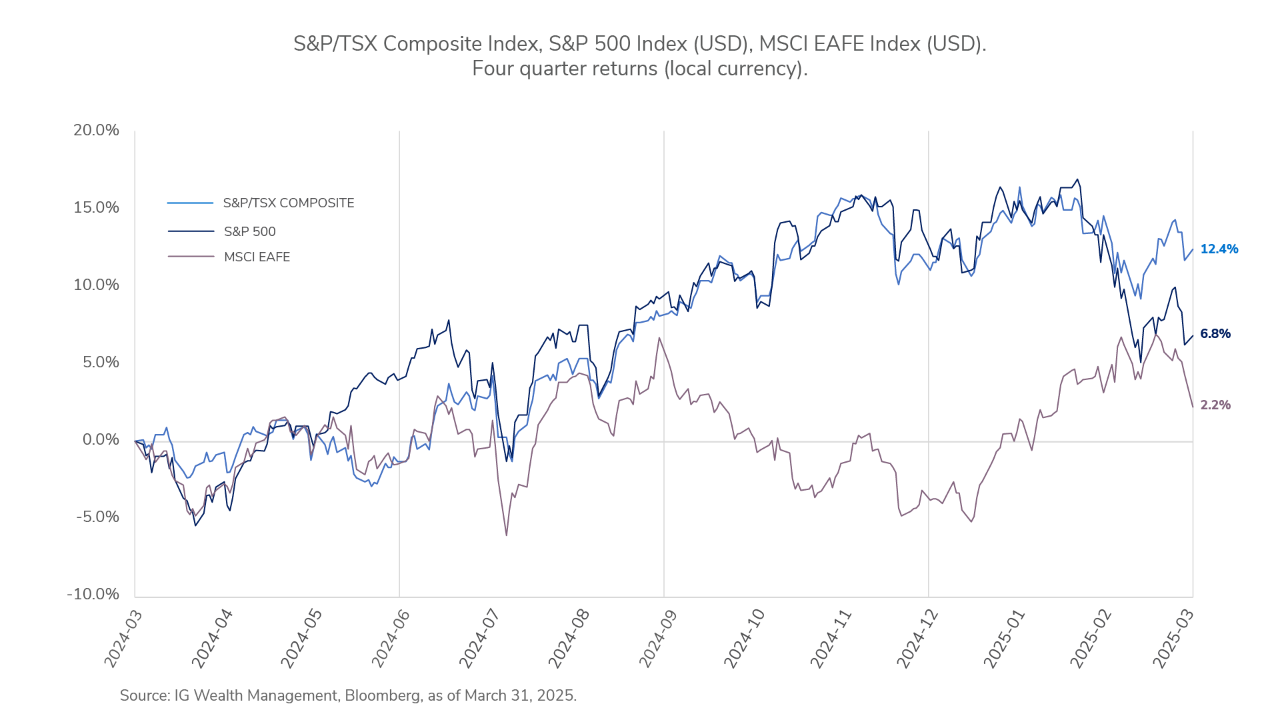

Investor sentiment turned cautious in the first quarter of 2025, driven by heightened market uncertainty following significant shifts in U.S. trade policy under President Trump. Abrupt tariff changes targeting major trade partners — notably Canada, Mexico and China — increased volatility and pressured equity market performance, particularly affecting the S&P 500 Index. In contrast, European markets outperformed significantly, reflecting investors' preference for Europe's attractive valuations and perceived stronger growth potential.

Despite trade-related headwinds, global manufacturing activity showed resilience, signalling potential earnings growth ahead, provided trade tensions stabilize. Central banks diverged in response: the Bank of Canada proactively lowered its overnight rate to 2.75% to bolster growth amid trade uncertainties, while the U.S. Federal Reserve maintained its rate at 4.5%, viewing tariff-related inflation impacts as temporary.

Market outlook: U.S. tariff concerns may temper earning expectations.

Looking ahead, we remain optimistic, despite recent market volatility and lingering uncertainties. While U.S. equities have faced challenges, including a pullback from February highs and sensitivity to tariff concerns, other regions, such as Canada, Europe and emerging markets, offer compelling opportunities. These regions have shown resilience, supported by stronger fundamentals and more attractive valuations compared to U.S. markets. As long as unemployment remains low, consumption is expected to continue at a steady pace, supporting economic growth. Despite short-term turbulence, global opportunities continue to emerge, and maintaining a long-term perspective will be key to navigating this market volatility.

To discuss your investment strategy, speak to your IG Advisor.

Azure Managed Investments™ provides discretionary investment management services distributed by Investors Group Securities Inc. (“IGSI”). IGSI will manage your Azure Managed Investments Accounts on a segregated basis in accordance with your investment policy statement and the resulting mandate selected by you. Mandates will be managed by Mackenzie Financial Corporation. You are required to make a minimum initial investment of $150,000; please read the Azure Managed Investment Account Agreement for complete details, including fees and expenses.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. It may contain certain forward-looking statements regarding the market conditions which are based upon assumptions believed to be reasonable at the time of publishing. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

© Investors Group Inc. 2025