Portfolio returns: Q3 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. July 16, 2014 |

IG Core Portfolio – Global Income F | 0.98

| 1.39

| 2.89

| 2.16

| 4.68

| 1.38

| 2.39

| 2.80

|

Quartile rankings | 3 | 4 | 4 | 4 | 4 | 3 | 4 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. July 16, 2014 |

IG Core Portfolio – Global Income F | 0.98

| 1.39

| 2.89

| 2.16

| 4.68

| 1.38

| 2.39

| 2.80

|

Quartile rankings | 3 | 4 | 4 | 4 | 4 | 3 | 4 |

The third quarter of 2025 began with a relatively constructive tone in risk markets, but the narrative shifted as downward revisions to labour market data, central bank actions and geopolitical developments introduced new layers of uncertainty.

The third quarter of 2025 began with a relatively constructive tone in risk markets, but the narrative shifted as downward revisions to labour market data, central bank actions and geopolitical developments introduced new layers of uncertainty.

The most notable development in the U.S. was the U.S. Federal Reserve’s decision to cut the federal funds rate by 25 basis points (a quarter of a percentage point) at its September meeting, bringing the target range to 4%–4.25%. This marked the first rate cut since December 2024 and came amid growing evidence of labour market softening. The July employment report revealed historic downward revisions to prior payroll data; May and June job gains were revised down by a combined 258,000, significantly altering the near-term assessment of labour market strength. Market pricing now reflects expectations for an additional 50 basis-point (half a percentage point) cut by year-end, with additional cuts in 2026.

U.S. Treasury yields were mixed over the quarter. The two-year yield fell by 11 basis points (0.11 of a percentage point), while the 10-year and 30-year yields declined by eight and four basis points (0.08 and 0.04 of a percentage point) respectively. The curve remains steep relative to earlier in the year, reflecting both easing expectations and a reassessment of long-term inflation risks. The U.S. CDX IG index (which monitors the credit risk of large North American companies) ended the quarter at 52 basis points, down modestly from 54 basis points at the start, with spreads remaining resilient despite macro volatility.

The Bank of Canada cut interest rates in September, which was largely expected by market participants. With the domestic economy showing signs of softness, the case for additional rate cuts continues to build. Unemployment in Canada continued to move higher, hitting its highest level in four years at 7.1%. Canadian yields declined across the curve, with two-year yields falling by 12 basis points, five-year yields down eight basis points and 10-year yields lower by nine basis points. The 30-year yield, however, rose by seven basis points, reflecting concerns around long-term fiscal sustainability. The spread between Canadian and U.S. 10-year yields remained compressed, trading in a tight range around 95 basis points, down from the highs of 150 basis points earlier in the year.

The Mackenzie IG Global Bond Pool is the largest weighted allocation in the portfolio and the largest contributor to performance. Global bonds posted positive returns during the period, as the market shifted from a focus on upside inflation to concerns around growth.

The Mackenzie Core Plus Global Fixed Income ETF is the third-largest weighted allocation in the portfolio and a positive contributor to performance. The fund posted positive returns, as North American government bonds rallied and credit spreads became tighter.

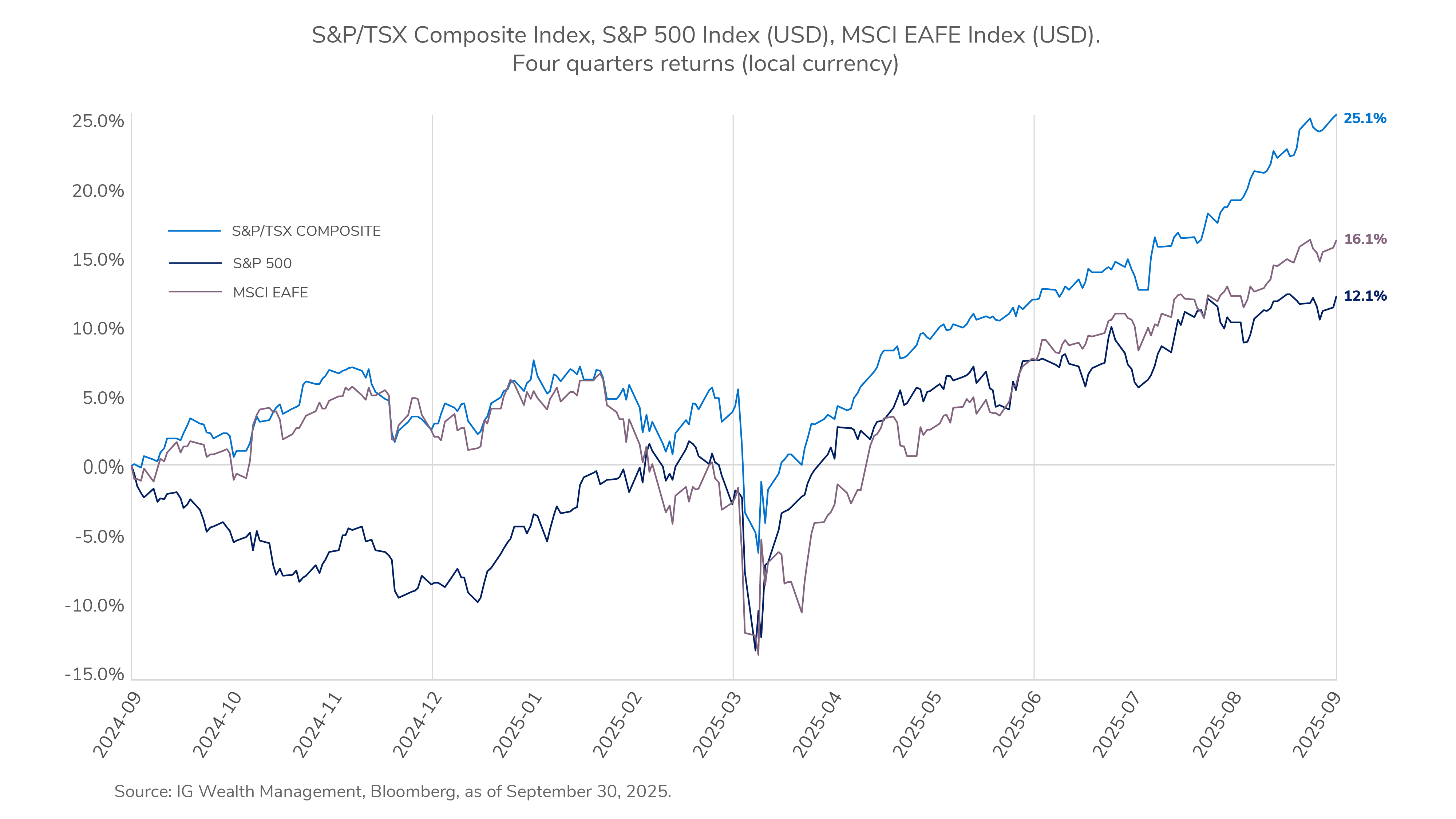

The third quarter delivered broad gains across asset classes, with market performance largely overriding a backdrop of cautious sentiment. Investors looked past persistent trade policy headlines, increasingly treating the U.S. administration's tariff policy as noise rather than a core risk. The primary catalysts for the positive performance were a subtle shift toward lower-interest-rate expectations and resilient corporate earnings.

Signals from the U.S. Federal Reserve of imminent rate cuts were followed by a quarter percentage cut in September. Government bond yields eased into the quarter's end, supporting bond prices, while corporate bonds outperformed government bonds.

Looking ahead, we remain cautious. The market continues to price in a benign outcome: moderating inflation and gradual policy easing. However, we are mindful of fragilities, particularly around labour market visibility and the potential for policy missteps. In Canada, the convergence of yields with the U.S. remains a theme we are watching closely and positioned for.

Credit remains expensive relative to historical norms, but high all-in yields and positive fund flow continue to support tight spreads. In our view, valuations appear stretched, particularly in an environment where fundamentals have deteriorated. We are maintaining a disciplined approach to credit selection, focusing on higher-quality issuers and more defensive sectors, such as utilities and pipelines. These sectors offer more predictable cash flows and benefit from regulatory tailwinds. Finally, we have also been underweighting the automotive and shipping/logistics sectors, where we believe the impact of trade dynamics are likely to be more pronounced.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of September 30, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2025 IGWM Inc.