Portfolio returns: Q3 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Low Volatility Portfolio – Balanced F | 3.43

| 6.36

| 11.23

| 14.53

| 15.55

| 9.68

| 7.91

| 7.44

|

Quartile rankings | 2 | 3 | 2 | 2 | 2 | 2 | 2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Low Volatility Portfolio – Balanced F | 3.43

| 6.36

| 11.23

| 14.53

| 15.55

| 9.68

| 7.91

| 7.44

|

Quartile rankings | 2 | 3 | 2 | 2 | 2 | 2 | 2 |

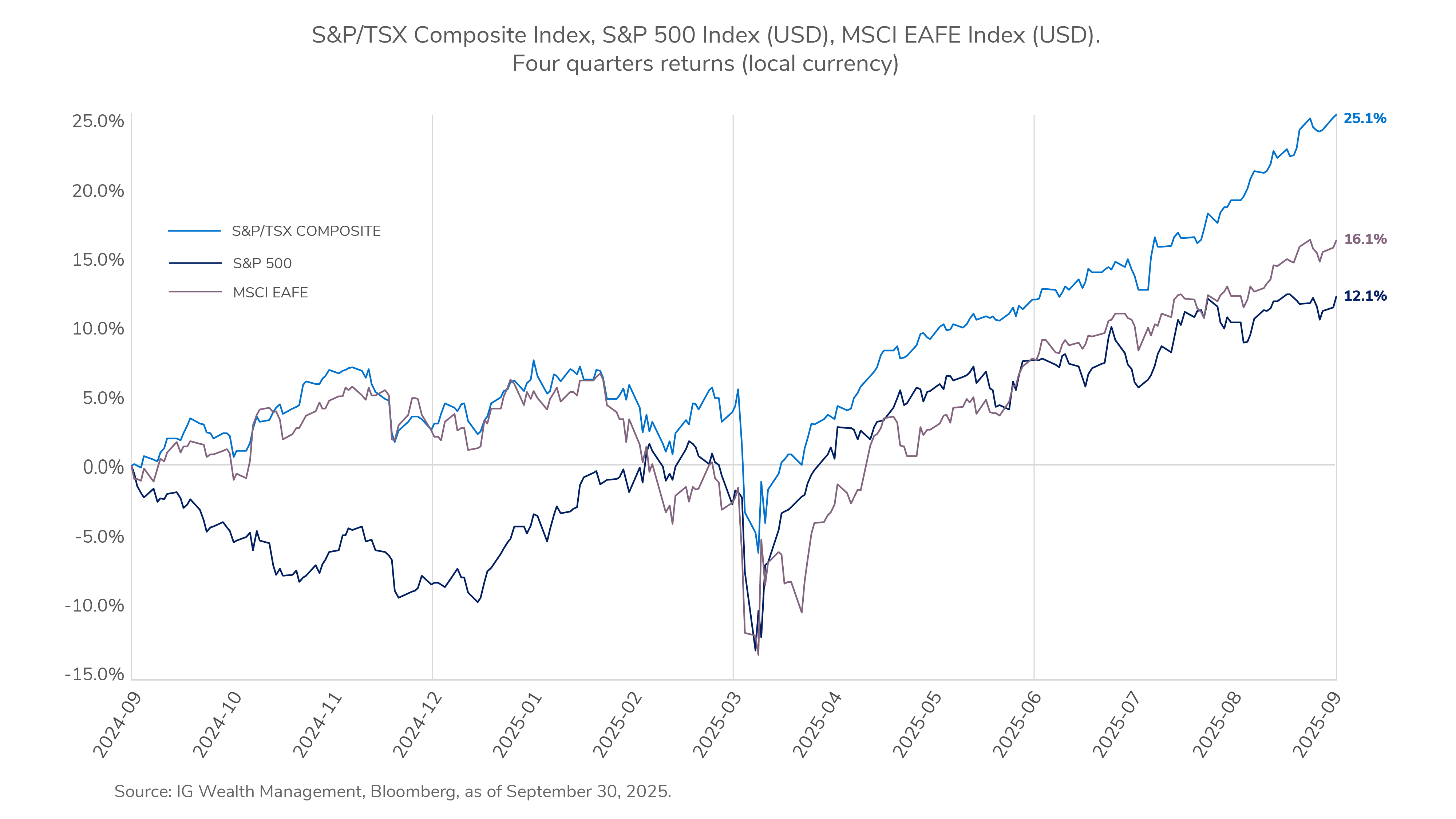

Equity and credit markets provided a constructive backdrop in the third quarter, helping support portfolio returns. North American equities advanced, driven by strength in the information technology and materials sectors, while expectations of central bank easing reinforced investor confidence. Bond markets, particularly in the U.S., delivered solid gains, while credit spreads remained tight amid steady corporate fundamentals. Our equity overweight position contributed positively, as global stocks outperformed fixed income. Having benefited from the interest rate differential between the U.S. and Canada, the portfolio continued to gradually increase its allocation to Canadian bonds, reducing our U.S. fixed income overweight position. Meanwhile, the portfolio maintained a neutral position in fixed income. While the portfolio is underweight fixed income, it maintains an overweight to the U.S. dollar, which made a positive contribution to portfolio performance in the third quarter.

Equity and credit markets provided a constructive backdrop in the third quarter, helping support portfolio returns. North American equities advanced, driven by strength in the information technology and materials sectors, while expectations of central bank easing reinforced investor confidence. Bond markets, particularly in the U.S., delivered solid gains, while credit spreads remained tight amid steady corporate fundamentals. Our equity overweight position contributed positively, as global stocks outperformed fixed income. Having benefited from the interest rate differential between the U.S. and Canada, the portfolio continued to gradually increase its allocation to Canadian bonds, reducing our U.S. fixed income overweight position. Meanwhile, the portfolio maintained a neutral position in fixed income. While the portfolio is underweight fixed income, it maintains an overweight to the U.S. dollar, which made a positive contribution to portfolio performance in the third quarter.

The IG Low Volatility Portfolio – Balanced generated a positive return this quarter, benefiting from strong equity and fixed income returns. All underlying funds within the portfolio contributed positively to performance except the IG Mackenzie Real Property Fund.

Among equities, the Mackenzie – IG Equity Pool, Mackenzie IG Low Volatility Canadian Equity Pool and Mackenzie Canadian Dividend Fund were the top contributors to performance. The Mackenzie – IG Equity Pool was the largest contributor, benefiting from overweight positions in industrials and consumer staples, and strong selection in financials and materials sectors, though it modestly trailed its benchmark, due to underweights in information technology and materials sectors. The Mackenzie IG Low Volatility Canadian Equity Pool also contributed positively, supported by gains in materials and its focus on stable, dividend-paying businesses that delivered steady returns in a rising market. The Mackenzie Canadian Dividend Fund added to results, led by strength in industrials and information technology holdings.

Within fixed income, the Mackenzie IG Canadian Bond Pool and Mackenzie – IG Canadian Corporate Bond Pool were the leading contributors. The Mackenzie IG Canadian Bond Pool benefited from effective federal bond selection and overweight exposure to federal and corporate bonds, while the Mackenzie – IG Canadian Corporate Bond Pool gained from strong security selection in the energy and communication services corporate bonds.

The IG Mackenzie Real Property Fund was the only fund that detracted from the performance. The fund underperformed primarily because of valuation markdowns on office assets and the reclassification of a retail property to development land, which offset otherwise stable income and occupancy metrics.

The third quarter delivered broad gains across asset classes, with market performance largely overriding a backdrop of cautious sentiment. Investors looked past persistent trade policy headlines, increasingly treating the U.S. administration's tariff policy as noise rather than a core risk. The primary catalysts for the positive performance were a subtle shift toward lower-interest-rate expectations and resilient corporate earnings.

Signals from the U.S. Federal Reserve of imminent rate cuts were followed by a quarter percentage cut in September. Government bond yields eased into the quarter's end, supporting bond prices, while corporate bonds outperformed government bonds.

IG Low Volatility Portfolios had a good Q3 relative to our peers. Despite the market uncertainty that roiled global markets earlier this year, we remained focused on fundamentals. We maintained our preference for equities over fixed income and were rewarded by the market, as both Canadian and U.S. equities outperformed bonds.

While we are in the midst of a U.S. government shutdown, history shows that these pauses in government funding have not resulted in meaningful changes to U.S. gross domestic product or corporate profits. We continue to maintain our overweight position in equities, as fundamentals, particularly in the U.S., along with seasonal factors, remain supportive of stocks.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of September 30, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2025 IGWM Inc.