Portfolio returns: Q3 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (October 30, 2023) |

Canadian Fixed Income Balanced Series I | 2.66

| 3.90

| 7.00

| 8.27

| 13.28

| |||

Quartile rankings | 1 | 1 | 2 | 1 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (October 30, 2023) |

Canadian Fixed Income Balanced Series I | 2.66

| 3.90

| 7.00

| 8.27

| 13.28

| |||

Quartile rankings | 1 | 1 | 2 | 1 |

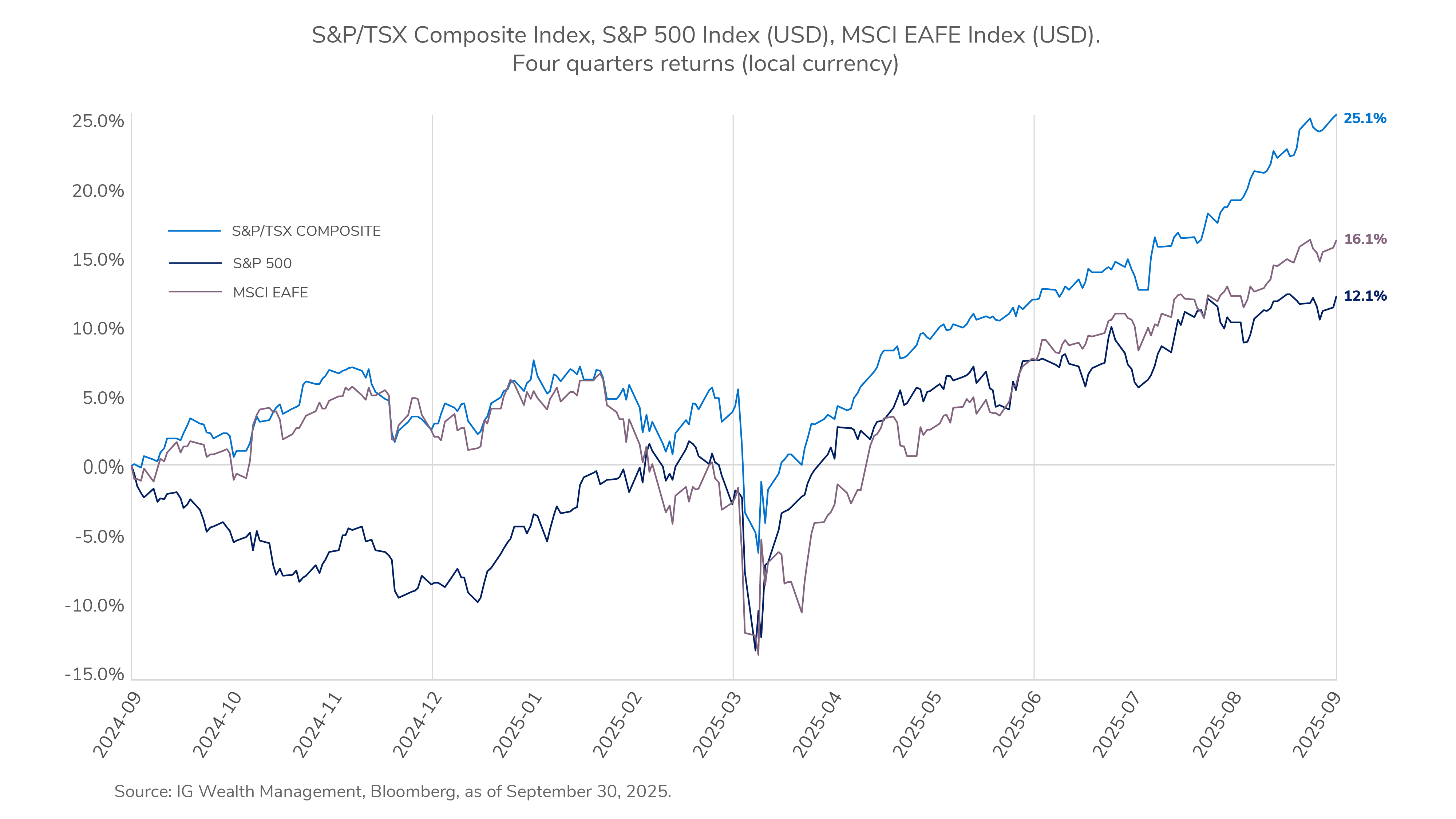

Global markets advanced in Q3 2025, fuelled by strength in AI-related stocks, easing trade tensions and central bank rate cuts. The U.S. Federal Reserve and Bank of Canada each cut rates by 25 basis points (a quarter of a percentage point), citing slowing job growth. U.S. equities hit record highs, led by AI-related and small-cap stocks. Canadian markets benefited from strength in the materials, information technology and energy sectors. Emerging markets surged, supported by Chinese technology stocks and a weaker U.S. dollar. Gold rallied to historic highs, while oil prices dipped on soft demand and rising supply. Bond markets posted modest gains; high-yield bonds outperformed investment-grade bonds, and emerging-market bonds also benefited from a softer U.S. dollar.

Global markets advanced in Q3 2025, fuelled by strength in AI-related stocks, easing trade tensions and central bank rate cuts. The U.S. Federal Reserve and Bank of Canada each cut rates by 25 basis points (a quarter of a percentage point), citing slowing job growth. U.S. equities hit record highs, led by AI-related and small-cap stocks. Canadian markets benefited from strength in the materials, information technology and energy sectors. Emerging markets surged, supported by Chinese technology stocks and a weaker U.S. dollar. Gold rallied to historic highs, while oil prices dipped on soft demand and rising supply. Bond markets posted modest gains; high-yield bonds outperformed investment-grade bonds, and emerging-market bonds also benefited from a softer U.S. dollar.

The iProfile™ Enhanced Monthly Income Portfolio – Canadian Fixed Income Balanced posted a positive return for the quarter, with all underlying funds producing gains.

The Mackenzie - IG Canadian Bond Pool, the heaviest weighted fund in the portfolio at 65%, was the topmost performer, and it also outperformed its benchmark. Government bond selection and an overweight to corporate bonds bolstered results.

The iProfile Canadian Dividend and Income Equity Private Pool, with an allocation of 13%, was the second-highest contributor. The fund posted a positive return. Strong stock selection in the industrials and health care sectors supported performance. Stock selection and an underweight to the materials sector was a major detractor to relative performance versus the benchmark.

With an allocation of 11%, the iProfile U.S. Equity Private Pool was the next positive contributor in the portfolio. The fund achieved a positive return. The fund benefited from stock selection in the information technology sector. Stock selection, primarily in the financials and consumer discretionary sectors, detracted from its relative performance.

The iProfile International Equity Private Pool, with an allocation of 7%, was another positive contributor, boosted by returns from the financials and industrials sectors.

The third quarter delivered broad gains across asset classes, with market performance largely overriding a backdrop of cautious sentiment. Investors looked past persistent trade policy headlines, increasingly treating the U.S. administration's tariff policy as noise rather than a core risk. The primary catalysts for the positive performance were a subtle shift toward lower-interest-rate expectations and resilient corporate earnings.

Signals from the U.S. Federal Reserve of imminent rate cuts were followed by a quarter percentage cut in September. Government bond yields eased into the quarter's end, supporting bond prices, while corporate bonds outperformed government bonds.

Our outlook for equities became positive in the period, as global markets proved resilient, with improving earnings revisions and stronger investor sentiment. We believe share valuations in Japan remain reasonable, and longer-term metrics suggest that developed international and emerging markets are more attractively valued than those in the United States and Canada.

We believe policy uncertainty and slower global growth are likely to cap inflation. Because tariff-related price increases appear transitory, we do not expect a lasting impact on fixed income investments. In Canada, we believe softer economic data has increased the likelihood of additional Bank of Canada policy rate cuts. In the United States, a more accommodative tone from the U.S. Federal Reserve and mounting fiscal and debt concerns led markets to price in further interest rate cuts into 2026, which we believe could pressure the U.S. dollar.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of September 30, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2025 IGWM Inc.