A plan that can adapt for the unplanned

A good financial plan provides you with a clear and objective way to identify gaps and highlight opportunities. The IG Living Plan, is built on the idea that life is not static. As life changes and evolves, your plan needs to be dynamic to keep you on track to meet your goals, and embrace all of life’s possibilities.

Track the progress of your financial goals

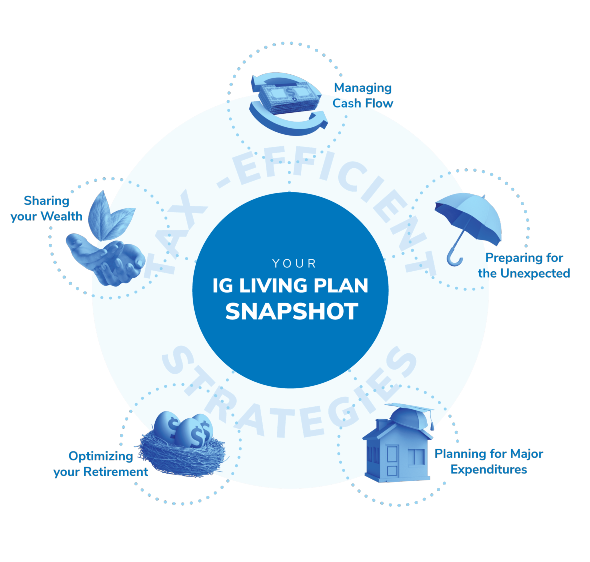

Once your IG Living Plan is established, your IG Consultant can provide you with a Living Plan Assessment at any time. This informative report provides a score for each of the five dimensions as well as an overall financial well-being score. The value of the report is its ability to proactively make recommendations on ways to improve your financial well-being over time. For example, you may have a lower score on preparing for the unexpected, this likely means that you would benefit by re-assessing your insurance coverage. Once the Living Plan Assessment is completed, you’ll enjoy the confidence of knowing where you stand in relation to your financial goals.

Share your experience

At IG we believe that all Canadians can benefit from higher levels of financial awareness and preparedness. That’s why we built an industry-first tool called the IG Living Plan Snapshot. This easy-to-use online tool is for people who do not yet have a comprehensive financial plan but are keen to understand their level of financial well-being. Through a series of questions, it produces a “snapshot in time” that identifies opportunities and areas for improvement. Consider sharing this tool with family and friends. Encourage them to take the quiz so they can see where they stand today and how they can better plan for tomorrow.

Take the Snapshot