What is an RESP? And how can it help pay for your kids’ education?

We all want the best for our kids, and helping them to get the best possible education is a priority for many parents. Having a post-secondary education is clearly a big advantage in life, which is probably why close to 60% of working-age Canadians have a college or university credential (the highest percentage among all of the G7 countries).

A university education doesn’t come cheap, however, and the costs involved can vary immensely, depending on the city, the university and the course taken. While the average annual tuition fee in Canada is around $7,000, that leaps up for certain subjects, such as law (around $13,000 on average), medicine (close to $15,000) and dentistry (around $23,000).

When you add to that accommodation costs (which can be upwards of $10,000 per year, depending on the university and/or the city the university is in), your child’s undergraduate university education costs could easily add up to more than $100,000.

Thankfully, the federal government introduced the Registered Educations Savings Plan back in 1974, to help parents, grandparents and friends to save for children’s education. It allows savings to grow tax-free and also boost the savings through additional contributions from government grants and bonds.

RESP funds can then be used to pay for education-related costs for anyone going to university, college, CEGEP, trade school or an apprenticeship program.

How does and RESP work?

You open a Registered Education Savings Plan with a financial institution (the promoter of the plan) and need the child’s social insurance number to do this. At the same time, you should ask the promoter to apply for the government benefits (the Canada Learning Bond [CLB] and the Canada Education Savings Grant [CESG]) that apply to the child (not all children qualify for the CLB).

Unlike with an RRSP, contributors to the plan don’t receive a tax deduction, however, all growth within the plan (such as interest, dividends and capital gains) is tax free until the funds are withdrawn, when the child begins post-secondary education. At that point, any withdrawals of money earned in the plan are considered income for the student and taxed accordingly (though all contributions made to the plan are paid out tax free). Normally, students don’t earn enough to be heavily taxed on their withdrawals, and some may not be taxed at all.

A child’s RESP in Canada can be opened by any adult, including their parent, grandparent, aunt/uncle or even a family friend. Adults aged 19-plus can open their own RESP and can receive CLB contributions until they reach 21. The person putting money into the RESP is called the subscriber and the child (or student) is called the beneficiary.

What is the Canada Education Savings Grant (CESG)?

The Canada Education Savings Grant is additional money provided by the federal government to increase your child’s education savings. To qualify, the beneficiary must:

- Have a social insurance number.

- Be a resident of Canada.

- Be 17 or younger.

- Be named as the beneficiary of an RESP.

The CESG contribution amount will depend on how much you contribute to the plan. Typically, the CESG is worth around 20% of the amount contributed in any given year, with the maximum amount normally $500 per year. Over the lifetime of the RESP, the maximum CESG amount is $7,200.

The CESG contribution could be higher if the beneficiary’s family’s income is below a certain threshold: children whose families have middle or low income could receive an additional $100 per year.

Some provincial governments also provide contributions to their residents’ RESPs, such as the B.C. Training and Education Savings Grant and the Quebec Education Savings Incentive.

What is the Canada Learning Bond (CLB)?

Similar to the Canada Education Savings Grant, the Canada Learning Bond provides additional money from the federal government, with the main differences being that it is a smaller amount and only available to people whose primary caregiver’s income is under a particular threshold (and which is adjusted depending on the number of children in the household).

Qualification requirements for the CLB are similar to those for the Canada Education Savings Grant, except that the beneficiary’s primary caregiver must also file tax returns and receive the Canada Child Benefit.

Unlike with the CESG, to receive the Canada Learning Bond, the subscriber doesn’t have to make any contributions. Qualifying beneficiaries can receive up to $500 in the first year after the plan is opened, plus $100 each year thereafter, until they turn 15. The maximum lifetime amount is $2,000.

When the child turns 19, they can subscribe to their own RESP and request CLB contributions until they turn 21.

What investments can you have in an RESP?

You don’t have to just save cash in an RESP. Similar to an RRSP and a TFSA, there is a wide range of investments available for RESPs in Canada:

- Mutual funds.

- ETFs.

- GICs (guaranteed investment certificates).

- Shares that are listed on designated stock exchanges (these can be in Canada and certain foreign countries).

- Bonds issued by the Canadian federal government, provincial governments, municipalities or Crown corporations.

- Corporate bonds listed on designated exchanges.

- Segregated funds.

- Certain other investments, such as specific types of mortgages, and small business corporation shares.

Ideally, you would hold a combination of some of the investments outlined above, to maximize the growth of your savings and provide diversification to protect them from any market volatility.

What is the RESP contribution limit?

There is no annual RESP contribution limit, however, the total lifetime limit that can be contributed to all of a beneficiary’s RESPs in Canada is $50,000. However, from the point of view of receiving the maximum amount from the Canada Education Savings Grant, it makes sense to spread the contributions over many years, because the maximum amount from the grant annually is just $500. By spreading out contributions over many years you’re more likely to receive the maximum CESG amount of $7,200.

What happens if you overcontribute to an RESP?

If you contribute more than the $50,000 RESP contribution limit, you’ll be subject to a tax of 1% per month on the amount above the RESP contribution limit. So, for example, if you contribute $55,000, you’ll pay a tax of $5,000 x 1% = $50.

If you find out that you’ve overcontributed to an RESP, you would need to fill out and file Form T1E-OVP (Individual Income Tax Return for RESP Overcontributions). You can also contact the Tax Service Office General Enquiries line at 1 800 959-8281.

How long can contributions be made to an RESP?

Usually, you can contribute for up to 31 years after the plan was opened. However, if the beneficiary is claiming the disability tax credit, they may be able to continue making contributions for up to 35 years.

When does an RESP have to end?

A Registered Education Savings Plan must normally be closed by the last day of the 35th year after it was opened, but this may be extended to the 40th year if the beneficiary is claiming the disability tax credit.

What are RESP withdrawal rules?

Payments made to students from their RESPs are called educational assistance payments (EAPs). RESP withdrawal rules state that, to receive the payments, they need to enroll in an eligible college, university or other educational institution.

They also need to be enrolled in a course that lasts at least 13 consecutive weeks (or three weeks for university programs). The financial company that holds the RESP is responsible for making sure that the school is eligible for RESP payments, but before your child registers for their chosen post-secondary educational institution, you should first check that it’s on this list of designated schools.

There are RESP withdrawal limits of $8,000 for full-time students and $4,000 for part-time students during the first 13-week period after enrolling in a qualifying educational program. After that, the beneficiary can withdraw any amount they need, with no limits, unless they quit their school and don’t re-enroll for 12 months. If this happens, the beneficiary has to go back to the original withdrawal limits, once they start a new qualifying educational program.

What can RESPs be used for?

Contrary to popular belief, funds from an RESP can be used to pay for much more than just tuition and text books. Students can also use money from their RESP to pay for any education-related expenses, such as:

- Housing costs (including private housing rent, residences and meal plans).

- Buying education-related equipment, such as a laptop.

- Buying course-specific materials and tools, such as paint, software and lab equipment.

- Extracurricular activity costs (such as athletic clubs).

- Transportation costs.

What are the advantages of RESPs?

If you want to help children to save for their post-secondary education, a Registered Education Savings Plan is the most efficient way to do it. These RESP advantages mean that it doesn’t make much sense to save for a child’s education any other way:

- You get free money from the government: your savings are increased by the CESG and the CLB (if your child qualifies). This extra money, plus the tax-free growth it enjoys, can have a considerable impact on your child’s overall education savings.

- All of your savings grow tax free: all growth in your investments (including interest, dividends and capital gains) are tax free until they’re withdrawn. This will help your savings grow much faster over time compared to a non-registered account, where earnings would probably be taxed.

- Withdrawals usually have zero or low tax: when students take out money to pay for their education, they are usually in the lowest tax bracket, and so typically pay little or no tax.

- You have a wide range of investment options: you aren’t restricted to just cash savings. You can invest in stocks, bonds, mutual funds, ETFs and other permissible investments.

- Anyone can contribute to it: grandparents, uncles, aunts and friends can all contribute to a child’s RESP, along with their parents.

You can read more about how RESPs can grow your child’s education savings faster.

RESP FAQs

How much should I put in an RESP every year?

Ideally, as much as you can afford, up to the RESP contribution limit of $50,000 in total. It makes sense to spread that amount over the number of years between now and your child starting post-secondary education. This will help maximize the government grant added to the savings, as there is a maximum amount that will be added each year.

Is it worth it to open an RESP account?

Absolutely. Up to $7,200 of government money will be added to your savings from the CESG and up to $2,000 from the CLB, if the student qualifies (and without having to make any RESP contributions yourself). The savings also grow tax free (until they’re withdrawn) unlike with unregistered accounts, where any investment growth is typically considered taxable income.

Can godparents or family friends contribute to an RESP for a child?

Anyone can contribute to an RESP, as long as there is sufficient RESP contribution room. However, if you want to set up an RESP for a child, you should contact their parents/guardians to make sure this won’t affect their other RESPs and also to obtain the child’s social insurance number, which is needed to open the account.

What happens to an RESP if it’s not used for school?

If the beneficiary of an RESP decides not to pursue post-secondary education, there are some options available. The RESP could be transferred to another child, you could transfer up to $50,000 to an RRSP, or withdraw the money contributed, along with any growth. Any grant or bond payments would be withheld.

How to get the most out of an RESP

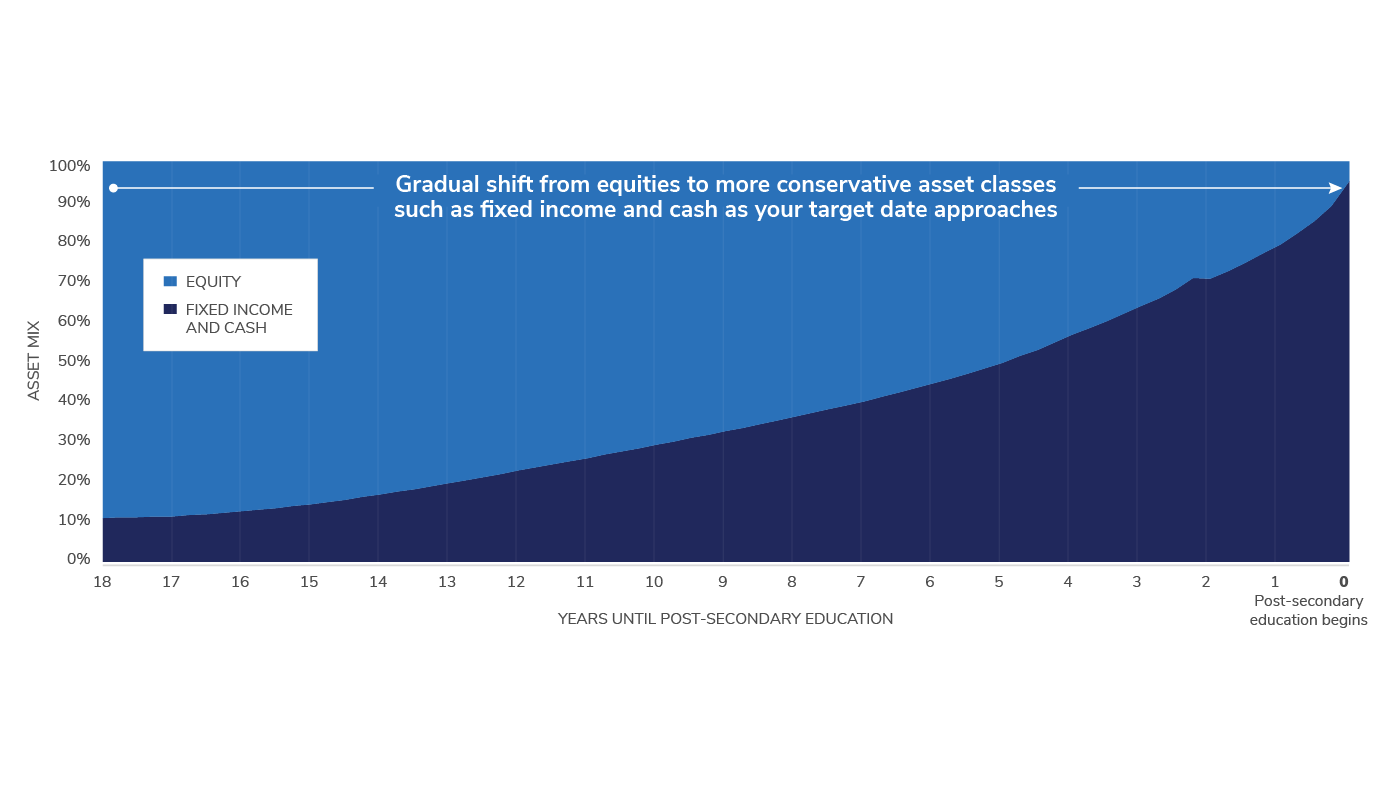

IG Target Education Portfolios are specifically designed to help investors grow their RESP savings. They take all the stress out of saving for your child’s education. They’re a suite of professionally managed and diversified portfolios whose asset mix evolves as the time of your child’s post-secondary education course approaches.

The underlying investments in the portfolios are managed by BlackRock, the world’s largest asset manager. All portfolios are constantly monitored and actively managed, so they manage risk and take advantage of different market conditions.

There are several portfolios to choose from, depending on when your child is expected to begin their post-secondary education. When they’re very young, their portfolio will hold a lot of equities (stocks) to maximize the potential for growth. As they approach the time when they’ll need to draw from their RESP money, their portfolio will have more bonds, to provide more protection in case the markets fall.

Each portfolio has broad diversification, with investments from a wide variety of geographical regions, sectors, types and company size. Simply choose the portfolio that aligns with the date your child is likely to start secondary education and leave the rest to us. When the portfolio reaches its target date (when your child will need to start withdrawing funds) the portfolio will switch to a Graduation Portfolio, which is designed to provide withdrawals while keeping the remaining money safe.

Find out more about how IG Target Education Portfolios work.

How to open an RESP

It’s really easy to open a Registered Education Savings Plan: to get started, you just need your child’s social insurance number after choosing your RESP promoter (the financial institution that will be providing the RESP).

- Your IG Advisor can help you to:

- Open the RESP account.

- Apply for the CESG and the CLB (if applicable).

- Set up your RESP contributions.

- Choose the most appropriate Target Education Portfolio to get the most out of your child’s RESP.

Your IG Advisor will also be able to make sure that your RESP contributions fit into your overall financial plan. Set up a meeting to discuss opening an RESP with your IG Advisor — if you don’t have an IG Advisor, you can find one here.

Written and published by IG Wealth Management as a general source of information only. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on your specific circumstances from an IG Wealth Management Consultant.

Commissions, fees and expenses may be associated with mutual fund investments and the use of IG Target Education Portfolios. Read the prospectus and speak to an IG Consultant before investing. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). And Additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

GICs issued by Investors Group Trust Co Ltd., and/or other non-affiliated GIC issuers. Minimum deposit, rates and conditions are subject to change without notice. Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). And Additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund. Written and published by IG Wealth Management as a general source of information only. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on your specific circumstances from an IG Wealth Management Consultant.

BlackRock® is a registered trademark of BlackRock, Inc. and its affiliates (“BlackRock”) and is used under license. BlackRock makes no representations or warranties regarding the advisability of investing in any product or service offered by IG Wealth Management. BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Wealth Management.

Insurance products and services distributed through I.G. Insurance Services Inc. (in Québec, a Financial Services Firm). Insurance license sponsored by The Canada Life Assurance Company (outside of Québec).