Today’s investors have the benefit of advanced science, coupled with leading-edge investment management practices, to create portfolios that automatically take advantage of the ups and downs of the market. That’s why investors who work with a professional advisor and invest according to a detailed plan don’t have to worry about trying to buy low and sell high.

Portfolio rebalancing helps avoid emotional investing

Common investor reactions to a falling market are to become upset, nervous and maybe even angry. It’s really important to be wary of these emotional responses to market volatility. Emotions can cause people to sell low and buy high. It’s the job of advisors to help their clients see the advantages of volatility at every life stage, instead of simply reacting to the constant ups and downs.

How to rebalance a portfolio to make volatility work for you

Markets are unpredictable. They go up and down all the time because the values of individual companies, sectors and regions are constantly changing. Knowing that there will be volatility is the only thing we can predict with certainty: this creates a huge opportunity to put it to work for you.

One way of making volatility work in your favour is to use automatic portfolio rebalancing. Investors who work with a good financial advisor don’t need to know how to rebalance a portfolio: their advisor will do this for them.

How portfolio rebalancing works

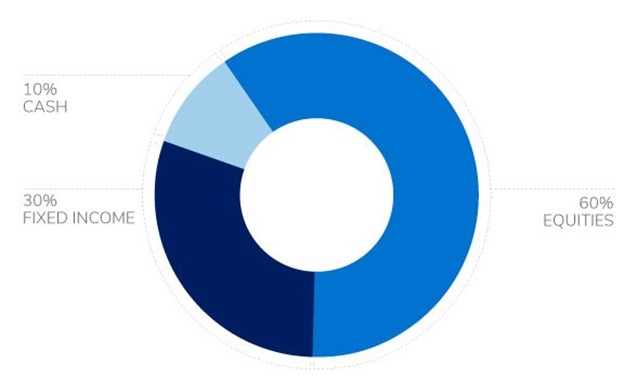

A typical investment portfolio is made up of three parts, or asset classes:

- Equities (individual company stocks or equity mutual funds and ETFs): these investments usually fluctuate the most.

- Fixed income investments (for example, GICs and bonds): these investments typically fluctuate less than equities.

- Cash and cash equivalents (for example, money market funds): these have virtually no fluctuation, except between different currencies.

The balance of each asset class is based on the investor profile that you created with your IG Consultant (based on your investment goals and risk tolerance). The portfolio below is a typical balanced portfolio:

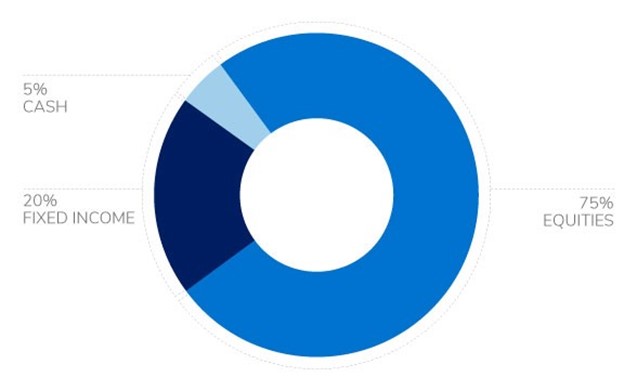

If the equity portion of this portfolio was to grow significantly faster than the fixed income and cash portions, the balance would be out of whack. It could look more like this.

If the equity portion of this portfolio was to grow significantly faster than the fixed income and cash portions, the balance would be out of whack. It could look more like this.

When looking at how to rebalance this portfolio, the financial advisor would sell some equities and move the profit into the other two portions. In simple terms, they would be selling high. The opposite is also true.

If the equity portion of a portfolio falls in value, it means those investments are worth less than they were when the portfolio was last rebalanced. To restore balance, money gets moved from the fixed income and cash portions to buy equites when they are cheaper. In simple terms, they would be buying low.

This process of automatic rebalancing overcomes the emotional biases that can affect an investor’s long-term potential to generate optimal returns. When investors understand how rebalancing works, they’re less inclined to feel anxious when markets dip. They can see volatility as an opportunity to buy low and sell high.

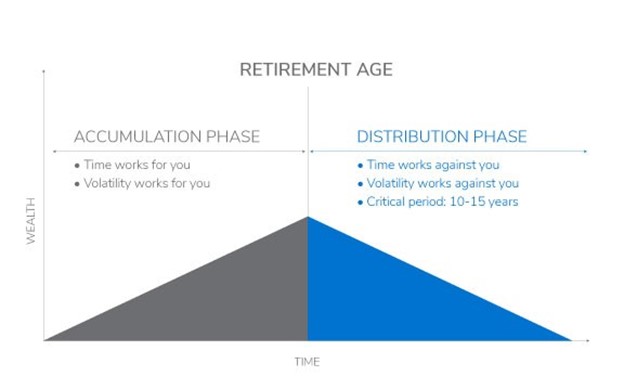

How to rebalance a portfolio throughout your life stages

Rebalancing plays a part in helping you reach your goals throughout your lifetime. During the accumulation phase of life, you’re trying to grow your assets. In the distribution phase, you are turning your assets into an income-generating machine that will pay for your retirement lifestyle.

If the equity portion of this portfolio was to grow significantly faster than the fixed income and cash portions, the balance would be out of whack. It could look more like this.

If the equity portion of this portfolio was to grow significantly faster than the fixed income and cash portions, the balance would be out of whack. It could look more like this.

Phase | Accumulation | Distribution |

Your focus | Growing assets that can be used to generate income in retirement. | Creating a steady, predictable income to pay for your lifestyle. |

How rebalancing works | With time on your side, you benefit from a longer period of compounding growth potential. Rebalancing ensures that you continue to buy low and sell high throughout your asset-growing years. | With a shorter time horizon, you want to avoid sudden dips in your portfolio that could take years to replenish. Rebalancing helps to stabilize your investment portfolio so that you can plan to withdraw a consistent amount every year. |

Discuss rebalancing with your IG Advisor

Your IG Advisor can go through how to rebalance your portfolio with you and show you how it can work for you at any stage of your financial journey.

Whether you’re accumulating money for retirement or looking for ways to create an effective income stream, IG Wealth Management has a wide offering of managed investment solutions that can put volatility to work for you. If you don’t have an IG Advisor, you can find one here.

Written and published by IG Wealth Management as a general source of information only, believed to be accurate as of the date of publishing. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. WITH Written and published by IG Wealth Management as a general source of information only. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on your specific circumstances from an IG Wealth Management Advisor.